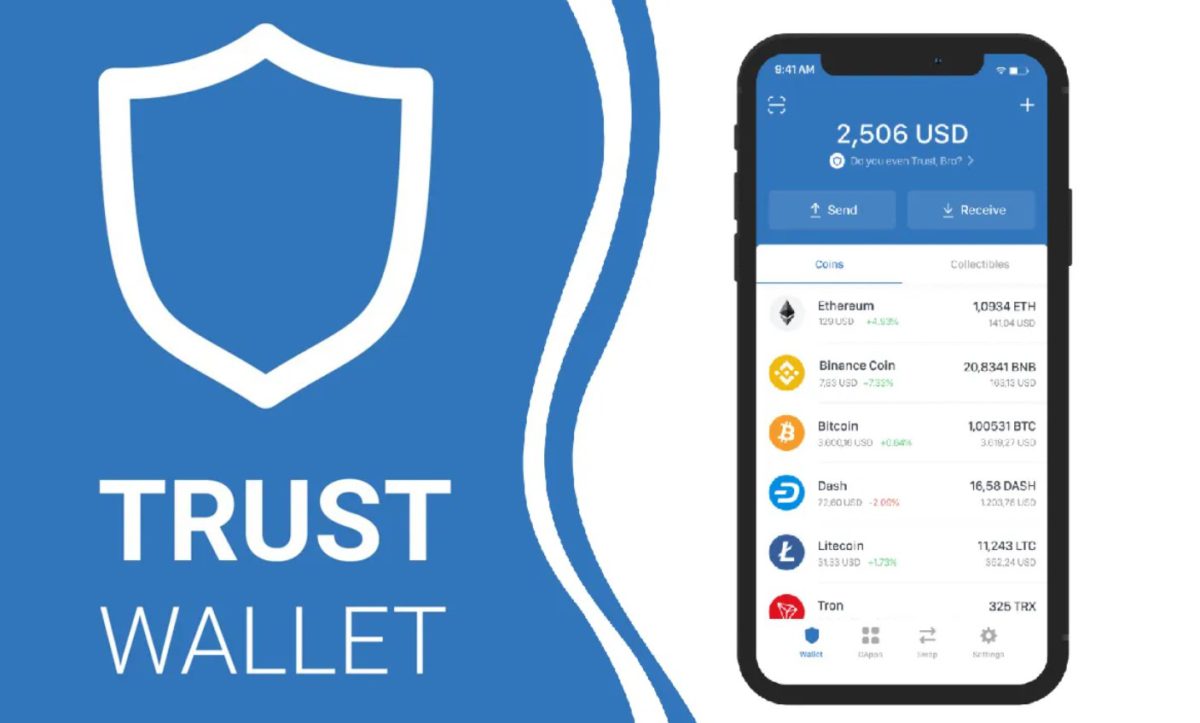

Trust Wallet Users Can Now File And Report Taxes In A One-Click Process

- Trust Wallet announces partnership with three crypto tax platforms; Coinpanda, Koinly, and Cointracker.

- The partnership will see Trust Wallet integrate the tax tools into the wallet.

- Users will receive discounts on their tax reports and filing.

One of crypto’s most famous self-custodial wallet and multi-chain mobile wallet, Trust Wallet, has announced the integration of three tax tools on its platform. In an announcement this Monday, Trust Wallet will integrate Coinpanda, Koinly, and CoinTracker to provide users with a simple, affordable and convenient crypto tax reporting tool.

As one of the largest self-custody wallets in Web 3, Trust wallet allows users to participate in decentralized finance (DeFi) platforms seamlessly, and the latest integrations further this goal. The integrations have been introduced as users enter the tax season, helping them get an idea of their tax liabilities and generate tax reports in just one click.

“We are very excited about our partnership with Trust Wallet […]. Users can easily calculate their taxes in time for the upcoming tax season,” said Jane McEvoy, Global Head of Partnerships at Koinly.

View more: List Of 10 Best Web3 Wallets

In addition, users will also be provided with free comprehensive insights and reports on their crypto holdings and investments, which helps them understand their assets even if they do not need to file taxes, as Eric Chang, Trust Wallet’s Head of Product, explained.

“Our free insights report offers a comprehensive overview of a user’s crypto holdings, which can be just as useful for those who don’t want to file taxes,” he said. “We’re committed to making the Trust Wallet experience as seamless as possible for our users. With this new feature, we’re taking another step towards empowering our users with insights and simplifying the crypto tax reporting process.”

The latest partnership follows the constant complaints from crypto users who can not file taxes due to a lack of know-how or the complexities involved in taxing cryptocurrencies. Users on the platform will not need to input any information manually but, via a one-click function, get their complete tax reports at their fingertips. The feature serves as an optional reference tool to help users more easily comply with tax regulations in different regions.

“We believe that everyone should be able to easily and accurately report their cryptocurrency taxes, regardless of their level of expertise,” said Eivind Semb, CEO and Founder at Coinpanda. “Together, we are making tax reporting accessible to everyone in the cryptocurrency community.”

Finally, Trust Wallet users will be eligible for discounted prices to use the tax tools and generate tax reports. By using any of the three partnering firms, Trust Wallet users will receive more affordable prices, and discounts will also be offered to holders of 50 $TWT and above.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Sui

Sui  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Stellar

Stellar  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  USDS

USDS  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Render

Render  Monero

Monero  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Tokenize Xchange

Tokenize Xchange  Dai

Dai  Filecoin

Filecoin  Arbitrum

Arbitrum