Top 10 Signs Of Cryptocurrency Scams That Are Very High Risk

Cryptocurrency is a digital or virtual form of currency that relies on encryption techniques to secure transactions and control the creation of new units. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks known as blockchains. These blockchains serve as distributed ledgers that record and verify all transactions made with the cryptocurrency. But this platform is not short of scams. How can you protect yourself from cryptocurrency scams?

The most well-known and widely used cryptocurrency is Bitcoin, which was introduced in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin laid the foundation for the development of numerous other cryptocurrencies, often referred to as altcoins.

The key features of cryptocurrencies include:

1. Decentralization: Cryptocurrencies are not controlled by any central authority, such as a government or a financial institution. Instead, they operate on decentralized networks of computers, ensuring that no single entity has control over the currency.

2. Security: Cryptocurrencies use advanced cryptographic techniques to secure transactions and control the creation of new units. This makes them highly resistant to fraud and counterfeiting. Transactions are verified by network participants through a process known as consensus, which typically involves mining or staking.

3. Anonymity and Privacy: While cryptocurrencies offer a certain level of anonymity, the extent of privacy varies among different cryptocurrencies. Some cryptocurrencies, like Bitcoin, provide pseudonymity, where transactions are recorded on the blockchain but are not directly linked to the participants’ real-world identities. Other cryptocurrencies, like Monero and Zcash, focus on enhanced privacy features, aiming to provide untraceable transactions.

4. Limited Supply: Many cryptocurrencies have a finite supply, meaning there is a maximum number of units that can ever exist. For example, Bitcoin has a capped supply of 21 million coins. This limited supply can contribute to the value and scarcity of the cryptocurrency.

5. Global Accessibility: Cryptocurrencies are accessible to anyone with an internet connection. They can be sent and received across borders without the need for traditional banking systems. This accessibility has made cryptocurrencies particularly useful in regions with limited access to banking services.

6. Programmability: Some cryptocurrencies, like Ethereum, allow the creation of smart contracts. Smart contracts are self-executing contracts with predefined rules and conditions encoded within the blockchain. They enable the development of decentralized applications (dApps) and facilitate more complex financial transactions.

Cryptocurrencies are used for various purposes, including:

1. Peer-to-Peer Transactions: Cryptocurrencies enable individuals to send and receive funds directly without the need for intermediaries like banks. This can result in faster and cheaper transactions, especially for cross-border transfers.

2. Investments and Speculation: Many people view cryptocurrencies as investment assets, hoping that their value will increase over time. Cryptocurrency markets are known for their volatility, presenting both opportunities and risks for investors and traders.

3. Fundraising: Cryptocurrencies have been used for crowdfunding purposes through Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs). These methods allow startups to raise funds by selling tokens or coins to investors.

4. Store of Value: Some individuals consider cryptocurrencies as a store of value or a hedge against inflation, similar to precious metals like gold.

5. Remittances: Cryptocurrencies can facilitate low-cost and efficient remittance services, particularly for individuals sending money to countries with limited banking infrastructure.

It’s important to note that while cryptocurrencies offer many advantages, they also present certain challenges and risks. These include regulatory concerns, market volatility, cybersecurity threats, scalability issues, and potential use in illicit activities. As the cryptocurrency space continues to evolve, governments and regulatory bodies are developing frameworks to address these challenges and ensure consumer protection.

Importance of cryptocurrency for the economy

Cryptocurrency plays a significant role in the economy and can have several important implications. Here are some reasons why cryptocurrencies are considered important:

1. Financial Inclusion: Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations. In many developing countries, traditional banking services are inaccessible or too expensive for a significant portion of the population. Cryptocurrencies offer a decentralized and low-cost alternative, enabling individuals to participate in the global economy and access financial services such as payments, savings, and investments.

2. Efficient and Cost-Effective Transactions: Cryptocurrencies can improve the efficiency and reduce the costs associated with financial transactions, particularly for cross-border payments. Traditional methods often involve intermediaries, such as banks or remittance services, which can lead to delays and high fees. Cryptocurrencies enable direct peer-to-peer transactions without the need for intermediaries, resulting in faster and cheaper transfers, especially for international remittances.

3. Innovation and Technological Advancement: Cryptocurrencies are built on blockchain technology, which has broader applications beyond the financial sector. The development of cryptocurrencies has sparked innovation in areas such as distributed ledger technology, smart contracts, and decentralized applications. These advancements have the potential to streamline processes, enhance security, and create new business models across various industries, leading to economic growth and job creation.

4. Investment Opportunities: Cryptocurrencies have emerged as a new asset class, providing individuals with investment opportunities outside of traditional financial markets. Cryptocurrency investments can diversify portfolios and potentially generate significant returns. This has attracted interest from institutional investors, venture capitalists, and retail investors, contributing to capital formation and stimulating economic activity.

5. Entrepreneurship and Job Creation: The rise of cryptocurrencies has fostered entrepreneurship and the development of new businesses. Cryptocurrencies offer a decentralized and permissionless platform for individuals to create and launch their own projects, often through Initial Coin Offerings (ICOs) or crowdfunding campaigns. This has led to the emergence of innovative startups and the creation of job opportunities in areas such as blockchain development, cryptocurrency exchanges, wallet providers, and advisory services.

6. Financial Sovereignty: Cryptocurrencies empower individuals to have greater control over their own finances and assets. With traditional financial systems, individuals rely on banks and financial institutions to safeguard their funds. However, cryptocurrencies enable individuals to be their own custodians, giving them the ability to securely store and manage their assets without dependence on intermediaries. This financial sovereignty can protect individuals from certain risks, such as bank failures or government restrictions on capital movement.

7. International Trade and Commerce: Cryptocurrencies have the potential to facilitate international trade by eliminating the need for intermediaries and reducing transaction costs. With cryptocurrencies, businesses can engage in cross-border transactions without the need to convert currencies, simplifying the process and reducing foreign exchange risks. Additionally, smart contracts built on blockchain technology can automate trade processes, enhance transparency, and reduce the risk of fraud, benefiting global commerce.

8. Financial Stability and Resilience: Cryptocurrencies can provide an additional layer of financial stability and resilience. Traditional financial systems can be vulnerable to economic crises, inflation, and government interventions. Cryptocurrencies, with their decentralized nature and fixed supply, offer an alternative store of value that is not subject to the same risks. In times of economic uncertainty, individuals and businesses may turn to cryptocurrencies as a means of preserving their wealth and mitigating risks associated with traditional financial instruments.

9. Micropayments and Microtransactions: Cryptocurrencies enable micropayments and microtransactions with minimal fees. In traditional payment systems, the cost of processing small-value transactions can be disproportionately high due to transaction fees and infrastructure costs. Cryptocurrencies allow for seamless and cost-effective transactions of very small amounts, enabling new business models and opportunities, such as pay-per-use services, content monetization, and cross-border microtransactions.

10. Transparent and Auditable Transactions: Blockchain technology, the underlying technology of cryptocurrencies, offers transparency and immutability. All transactions recorded on a blockchain are visible to network participants, ensuring a high level of transparency. This transparency can enhance trust in economic transactions and reduce fraud and corruption. Furthermore, the immutability of blockchain records allows for easy auditing, making it easier for businesses and regulatory authorities to verify transaction histories and ensure compliance.

11. Fundraising and Capital Formation: Cryptocurrencies have transformed the way businesses raise capital. Initial Coin Offerings (ICOs) and token sales provide an alternative method for startups and entrepreneurs to access funding. This has democratized the fundraising process, allowing investors of various sizes to participate in early-stage investment opportunities. By facilitating capital formation, cryptocurrencies contribute to entrepreneurial activity, innovation, and economic growth.

12. Cross-Border Trade and E-Commerce: Cryptocurrencies can facilitate cross-border trade and e-commerce transactions by eliminating currency conversion costs and reducing payment processing delays. With cryptocurrencies, merchants can accept payments from customers located anywhere in the world without the need for traditional payment gateways or intermediaries. This opens up new markets for businesses and promotes international trade, particularly for small and medium-sized enterprises (SMEs) that may face challenges with traditional banking and payment systems.

13. Financial Empowerment in Developing Economies: Cryptocurrencies have the potential to empower individuals in developing economies by providing them with access to financial services and opportunities that were previously inaccessible. In regions with high levels of financial exclusion, cryptocurrencies can enable individuals to participate in the global economy, access credit, and engage in economic activities. This can contribute to poverty reduction, economic development, and financial empowerment at the grassroots level.

14. Innovation in Financial Services: Cryptocurrencies and blockchain technology are driving innovation in the financial services industry. The emergence of decentralized finance (DeFi) has introduced new financial instruments and services that are accessible to anyone with an internet connection. DeFi platforms offer features such as lending, borrowing, yield farming, and decentralized exchanges, providing individuals with more control over their finances and eliminating the need for traditional intermediaries. This innovation promotes competition, efficiency, and the development of new business models within the financial sector.

15. Data Privacy and Security: Cryptocurrencies prioritize user privacy and security. With traditional financial systems, individuals often need to share personal information for transactions and account management. Cryptocurrencies, on the other hand, can offer a higher level of privacy by allowing individuals to transact pseudonymously or anonymously, depending on the specific cryptocurrency. This protection of personal data can help mitigate risks associated with data breaches and identity theft, contributing to a more secure and resilient economic environment.

These points highlight various aspects of how cryptocurrencies are important for the economy. As the technology and adoption of cryptocurrencies continue to evolve, their impact on the economy is likely to expand and bring about further changes to financial systems and economic structures.

Top 10 Signs of Cryptocurrency Scams

The cryptocurrency market is a hotbed of scams, and it’s important to be aware of the red flags so you can protect yourself. Here are the top 10 signs of a cryptocurrency scam:

- You receive an offer out of the blue. If you’re contacted out of the blue by someone offering you a great deal on cryptocurrency, it’s likely a scam. Legitimate investment opportunities don’t come knocking on your door.

- You see a celebrity endorsement that is actually a fake. Scammers often use fake celebrity endorsements to lure victims in. If you see a celebrity promoting a cryptocurrency, do your research to make sure it’s actually them.

- A romantic partner you only know online asks for money in crypto. If you’re in a romantic relationship with someone you only know online, and they start asking for money in cryptocurrency, it’s a scam. Don’t send them any money, no matter how much they promise you in return.

- You’re pressured into transferring crypto from your current exchange to another website. Legitimate cryptocurrency exchanges will never pressure you to transfer your funds to another website. If someone is pressuring you to do this, it’s a scam.

- You’re asked to pay for a financial service with crypto. Legitimate financial services providers don’t accept cryptocurrency as payment. If you’re asked to pay for a financial service with cryptocurrency, it’s a scam.

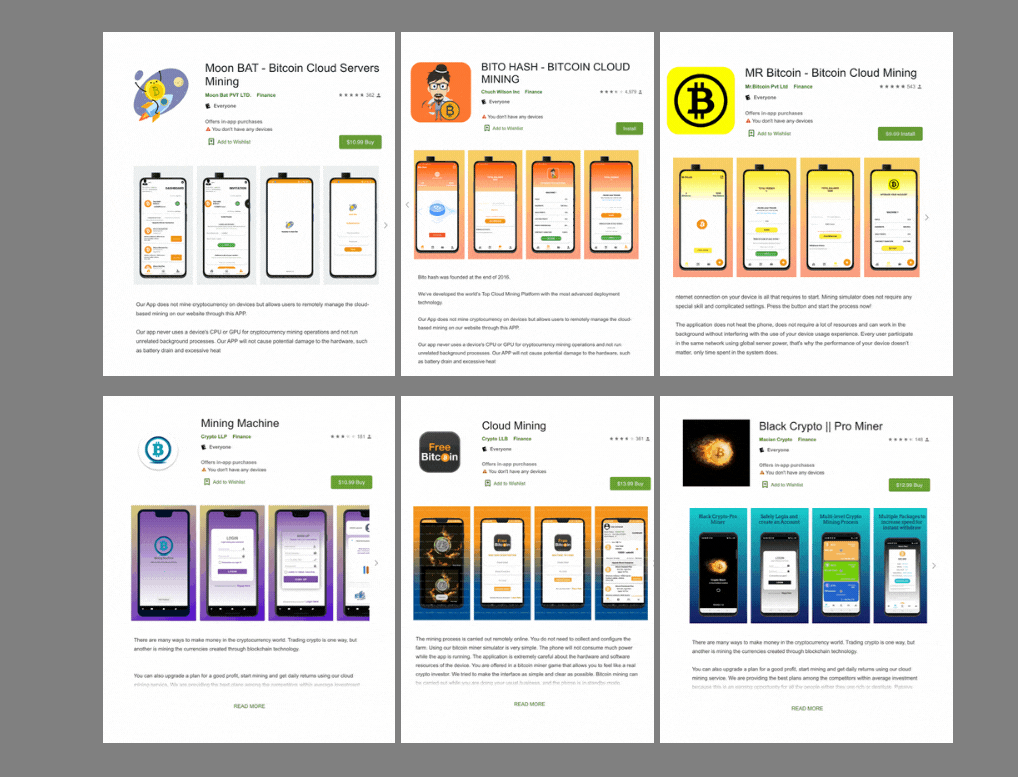

- The app you’re using or directed to isn’t listed on the Google Play Store or Apple Store. Scammers often create fake cryptocurrency apps that look like they’re from legitimate companies. If you’re not sure if an app is legitimate, check to see if it’s listed on the Google Play Store or Apple Store.

- You need to pay more to access your money. Legitimate cryptocurrency exchanges won’t charge you any fees to access your money. If you’re asked to pay a fee to access your money, it’s a scam.

- You are ‘guaranteed’ returns, or free money. There is no such thing as a guaranteed investment in cryptocurrency. If someone promises you guaranteed returns, or free money, it’s a scam.

- Strange tokens appear in your digital wallet. If you find strange tokens in your digital wallet, it’s possible you’ve been hacked. Scammers often send fake tokens to people’s wallets in the hopes that they’ll be mistaken for real tokens and exchanged for cryptocurrency.

- The exchange withholds investment returns for supposed “tax purposes”. Legitimate cryptocurrency exchanges will never withhold investment returns for supposed “tax purposes”. If an exchange tells you this, it’s a scam.

If you see any of these red flags, it’s important to walk away. Cryptocurrency scams are a major problem, and it’s important to protect yourself. By being aware of the red flags, you can help to keep your cryptocurrency safe.

Here are some additional tips to help you avoid cryptocurrency scams:

- Do your research before investing in any cryptocurrency.

- Only invest money that you can afford to lose.

- Use a reputable cryptocurrency exchange.

- Keep your cryptocurrency in a secure wallet.

- Be wary of any investment opportunity that seems too good to be true.

By following these tips, you can help to protect yourself from cryptocurrency scams.

Also read : Cryptocurrency: Futuristic Way Of Exchange Or A Ponzi Scheme?

Risks associated with Cryptocurrency

While cryptocurrencies offer numerous benefits, they also come with certain risks and challenges. It’s important for individuals and organizations to be aware of these risks before engaging with cryptocurrencies. Here are some key risks associated with cryptocurrencies:

1. Market Volatility: Cryptocurrency markets are known for their high volatility. Prices of cryptocurrencies can experience significant fluctuations within short periods. This volatility can result in substantial gains, but it also exposes investors to the risk of substantial losses. Sudden price movements can be influenced by various factors, including market speculation, regulatory announcements, and technological developments.

2. Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving in many jurisdictions. Governments and regulatory bodies are grappling with how to address cryptocurrencies and their impact on traditional financial systems. Regulatory actions, such as imposing restrictions or implementing new regulations, can have a significant impact on the value and usability of cryptocurrencies. Uncertainty around regulations creates risks for investors, businesses, and the overall stability of the cryptocurrency ecosystem.

3. Cybersecurity Threats: Cryptocurrency transactions and storage rely on digital platforms and wallets, making them susceptible to cybersecurity risks. Hacks, thefts, and fraudulent activities have occurred, resulting in the loss of significant amounts of cryptocurrency. Malicious actors may target cryptocurrency exchanges, wallets, or individual users to gain unauthorized access and steal funds. It is essential to implement strong security measures, such as using reputable platforms, employing multi-factor authentication, and storing cryptocurrency in secure wallets.

4. Operational Vulnerabilities: Cryptocurrency networks and platforms can experience operational vulnerabilities and technical issues. Software bugs, glitches, or network attacks can disrupt the functionality of cryptocurrencies and their underlying infrastructure. These disruptions can lead to delays in transactions, loss of funds, or temporary suspension of services. Users must be cautious when choosing platforms and stay informed about potential risks and updates.

5. Lack of Consumer Protection: Unlike traditional financial systems, cryptocurrencies generally do not have the same level of consumer protection mechanisms in place. Transactions made with cryptocurrencies are irreversible, and if funds are lost or stolen, there may be limited options for recourse. Additionally, fraudulent projects and scams have emerged in the cryptocurrency space, deceiving unsuspecting investors. Conducting thorough research, using trusted platforms, and exercising caution are crucial to minimize the risk of falling victim to scams or fraudulent activities.

6. Scalability and Technical Challenges: As cryptocurrencies gain popularity and usage increases, scalability becomes a significant challenge. Some cryptocurrencies, such as Bitcoin, have faced limitations in terms of transaction processing speed and scalability. Scalability issues can result in delays and higher transaction fees. Ongoing efforts are being made to address these challenges, such as through the development of layer-two solutions and alternative consensus algorithms.

7. Regulatory Compliance and Legal Issues: Cryptocurrencies can face legal and compliance challenges, especially when it comes to anti-money laundering (AML) and know-your-customer (KYC) regulations. Governments and regulatory bodies are increasingly focusing on ensuring that cryptocurrencies are not used for illicit activities such as money laundering, terrorism financing, or tax evasion. Compliance with these regulations may involve additional costs and administrative burdens for businesses and users.

8. Market Manipulation and Insider Trading: Cryptocurrency markets are relatively less regulated compared to traditional financial markets, making them vulnerable to market manipulation and insider trading. The lack of transparency and oversight can create opportunities for market participants to manipulate prices or profit from non-public information. Such activities can erode market confidence and impact the overall integrity of the cryptocurrency ecosystem.

9. Environmental Impact: The energy consumption associated with certain cryptocurrencies, especially those that rely on proof-of-work consensus mechanisms, has raised concerns about their environmental impact. The mining process requires significant computational power, leading to high energy consumption and carbon emissions. As the cryptocurrency ecosystem continues to grow, addressing the environmental impact and transitioning to more sustainable consensus mechanisms is crucial.

10. Perception and

Adoption Risks: The perception and adoption of cryptocurrencies can also pose risks. Negative media coverage, public skepticism, or lack of understanding about cryptocurrencies may lead to market sentiment swings and hinder mainstream adoption. Public perception can significantly influence the value and acceptance of cryptocurrencies, making them susceptible to sentiment-driven market movements.

It’s important to note that risk mitigation strategies, such as conducting thorough research, diversifying investments, implementing strong security measures, and staying informed about regulatory developments, can help individuals and organizations navigate the risks associated with cryptocurrencies. Additionally, seeking professional advice and understanding the risks before engaging with cryptocurrencies is advisable.

Also read : Rising Scams in Cryptocurrency and DeFi Projects You Should Know

Future of cryptocurrency

The future of cryptocurrency is a topic of much speculation and debate, as the technology continues to evolve and gain wider acceptance. While it is challenging to predict with certainty how the cryptocurrency landscape will unfold, there are several trends and developments that can shed light on potential future scenarios:

1. Increased Institutional Adoption: Institutional adoption of cryptocurrencies has been growing steadily. Major financial institutions, such as banks, asset management firms, and hedge funds, are showing increasing interest in cryptocurrencies as investment assets. Some institutions have even started offering cryptocurrency-related services to their clients. This institutional adoption brings legitimacy and liquidity to the market, potentially attracting more participants and driving further growth in the cryptocurrency ecosystem.

2. Regulatory Clarity: Regulatory frameworks for cryptocurrencies are gradually taking shape around the world. Governments and regulatory bodies are working to establish guidelines and regulations to address concerns such as consumer protection, money laundering, and market manipulation. Clear and balanced regulations can provide more certainty to businesses, investors, and users, fostering confidence and stability within the cryptocurrency industry.

3. Central Bank Digital Currencies (CBDCs): Several central banks are exploring the development and implementation of their own digital currencies, known as CBDCs. CBDCs aim to combine the advantages of cryptocurrencies, such as fast and efficient transactions, with the stability and regulatory oversight provided by central banks. The introduction of CBDCs could have a profound impact on the cryptocurrency landscape, potentially influencing the adoption and use of existing cryptocurrencies.

4. Interoperability and Scalability Solutions: As cryptocurrencies gain mainstream adoption, scalability and interoperability become crucial factors. Solutions such as layer-two protocols, sidechains, and cross-chain interoperability projects aim to address scalability issues and facilitate seamless transfer of assets between different blockchain networks. These advancements can improve transaction speeds, reduce fees, and enhance the overall usability and efficiency of cryptocurrencies.

5. Decentralized Finance (DeFi) Evolution: DeFi has emerged as a rapidly growing sector within the cryptocurrency ecosystem. DeFi platforms offer various financial services, such as lending, borrowing, decentralized exchanges, and yield farming, without the need for intermediaries. The future of DeFi holds the potential for further innovation, increased accessibility, and improved user experience. However, challenges such as security vulnerabilities and regulatory compliance will need to be addressed for sustainable growth.

6. Integration with Traditional Financial Systems: Cryptocurrencies are increasingly being integrated into traditional financial systems. Traditional financial institutions are exploring partnerships and collaborations with cryptocurrency companies to offer services such as custody, trading, and payment solutions. Integration with existing financial infrastructure can promote broader adoption of cryptocurrencies and provide seamless transitions between traditional and digital financial assets.

7. Improved User Experience: Enhancements in user experience, user interfaces, and infrastructure are key factors for widespread cryptocurrency adoption. Efforts are being made to simplify cryptocurrency wallets, improve security measures, and provide user-friendly platforms for buying, storing, and using cryptocurrencies. As user experience becomes more intuitive and user-friendly, barriers to entry are reduced, allowing for broader participation in the cryptocurrency ecosystem.

8. Environmental Sustainability: The environmental impact of cryptocurrency mining, particularly in proof-of-work-based networks, has drawn increasing attention. The future of cryptocurrency will likely involve a shift towards more energy-efficient consensus mechanisms, such as proof-of-stake or other environmentally friendly alternatives. Sustainable mining practices and initiatives to offset carbon emissions associated with cryptocurrency mining are also emerging.

9. Integration of Blockchain Technology: Blockchain technology, the underlying technology of cryptocurrencies, holds immense potential beyond the realm of digital currencies. The integration of blockchain into various industries, such as supply chain management, healthcare, identity verification, and voting systems, is expected to continue. This integration can bring transparency, security, and efficiency to existing systems, leading to increased productivity and reduced costs.

10. Global Financial Inclusion: Cryptocurrencies have the potential to address financial inclusion challenges, particularly in underserved regions. The ability to access financial services, such as payments, savings, and investments, through cryptocurrencies can empower individuals in developing economies and regions with limited access to traditional banking infrastructure. This can contribute to economic growth, poverty reduction, and greater financial inclusion on a global scale.

11. Enhanced Privacy Features: Privacy is an important aspect of cryptocurrencies. Future developments may focus on improving privacy features, such as introducing advanced encryption techniques, zero-knowledge proofs, and privacy-focused cryptocurrencies. These enhancements can provide individuals with greater control over their personal data and transaction privacy, while still adhering to regulatory requirements.

12. Integration of Artificial Intelligence (AI): The integration of artificial intelligence and machine learning with cryptocurrencies can bring about various advancements. AI algorithms can be utilized to analyze market trends, predict price movements, and provide more accurate trading signals. Additionally, AI can assist in monitoring blockchain networks for security threats and detecting fraudulent activities.

13. Tokenization of Real-World Assets: Cryptocurrencies enable the tokenization of real-world assets, such as real estate, artwork, commodities, and intellectual property. This process involves representing these assets as digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and easier transferability. The future may see a wider adoption of asset tokenization, enabling more efficient and accessible investment opportunities.

14. Cross-Border Payments and Remittances: Cryptocurrencies have the potential to revolutionize cross-border payments and remittances. Traditional international transfers can be expensive, slow, and subject to intermediaries. Cryptocurrencies can facilitate near-instantaneous, low-cost, and borderless transactions, making them an attractive solution for cross-border payments. This can have a significant impact on remittance markets, reducing costs and increasing financial inclusion for migrant workers.

15. Integration with Internet of Things (IoT): The integration of cryptocurrencies with the Internet of Things (IoT) can create new possibilities. IoT devices can engage in autonomous economic transactions, such as automated payments for services or machine-to-machine transactions using cryptocurrencies. This integration can enable seamless, secure, and efficient value exchange between connected devices, fostering the growth of the machine economy.

16. Global Regulatory Cooperation: As cryptocurrencies transcend geographical boundaries, global regulatory cooperation becomes crucial. Collaboration among governments, regulatory bodies, and industry stakeholders can help establish consistent and balanced regulations that foster innovation while safeguarding against risks. International coordination can reduce regulatory fragmentation, provide clarity for businesses and users, and promote global adoption of cryptocurrencies.

17. Education and Awareness: Increasing education and awareness about cryptocurrencies will play a vital role in shaping the future of the industry. As understanding and knowledge about cryptocurrencies and blockchain technology improve, more individuals, businesses, and governments will be able to make informed decisions and fully leverage the benefits offered by cryptocurrencies. Education initiatives, industry conferences, and mainstream media coverage can contribute to broader awareness and knowledge dissemination.

18. Decentralized Governance Models: The future may witness the emergence of decentralized governance models for cryptocurrencies and blockchain networks. Decentralized autonomous organizations (DAOs) allow stakeholders to collectively make decisions and govern the direction of a project or network. These models aim to increase transparency, eliminate centralized control, and enable community-driven decision-making processes.

19. Collaboration with Traditional Financial Institutions: Cryptocurrency projects and traditional financial institutions may continue to collaborate and bridge the gap between the traditional financial system and the cryptocurrency ecosystem. Partnerships, mergers, and acquisitions between crypto companies and established financial institutions can facilitate the integration of cryptocurrencies into existing financial infrastructure, further driving mainstream adoption.

20. Evolution of Stablecoins: Stablecoins, cryptocurrencies pegged to stable assets like fiat currencies, are gaining traction as a means of reducing volatility and facilitating everyday transactions. The future may see the development of improved stablecoin models, backed by diversified assets or utilizing advanced algorithms to maintain stability. Enhanced stability and scalability can make stablecoins more suitable for mainstream use, such as in e-commerce and everyday payments.

The SEC’s actions against cryptocurrency is exactly what we needed

As it gives our ecosystem more legitimacy & a chance to prove them wrong in court!

Regulation gives clarity, paving the way for institutional adoption

Do not let fear get the better of you; the future is bright

— Justin Bons (@Justin_Bons) June 11, 2023

It is important to note that the future of cryptocurrency will also be influenced by unforeseen factors, such as technological advancements, market dynamics, geopolitical events, and public sentiment. As the ecosystem continues to mature, navigating challenges and embracing opportunities will be crucial for the sustainable growth and development of cryptocurrencies.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Hyperliquid

Hyperliquid  Official Trump

Official Trump  USDS

USDS  Wrapped eETH

Wrapped eETH  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Ondo

Ondo  Mantle

Mantle  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Jupiter

Jupiter  Dai

Dai  MANTRA

MANTRA  Layer One X

Layer One X