Tim Draper and His Bitcoins

How long are you in the game for?

Can you stomach a loss of 70–80% if the price continues to go down?

If your answers are “several years” and you have the mental fortitude of a Buddhist monk, then you might be a good fit for bitcoin. :)

Let me share one story.

Billionaire VC investor Tim Draper has been investing in tech companies for a couple of decades now — including Tesla and SpaceX.

A few years ago he started his due diligence on bitcoin as a potential investment. He was intrigued for some of the same reasons a lot of us are.

Here’s what he wrote in a blog post:

“The obvious uses for bitcoin are 1) having a currency that is accepted everywhere without any government friction or interference, 2) a stored value solution that doesn’t require a holder to keep a room full of metals and art, and 3) a frictionless currency that can move automatically based on a contract without the usual drag that comes from regulations that need to be interpreted by a lawyer or an accountant.”

When the government seized thousands of bitcoin from the Silk Road bust (a platform where drugs were sold in exchange for btc), 36,000 bitcoins were put up for bid.

Tim Draper bid the highest, paying $632 for 36,000 bitcoins. This means he dropped $22.7 million dollars to buy all that btc. Some estimates put it lower than that (around 17m usd) — but you get the point, it was a big bet!

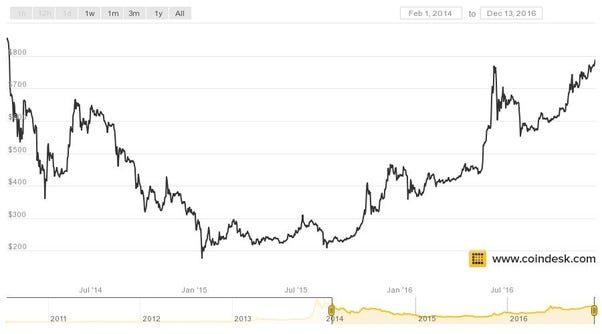

The btc price was around $600 during that time, so while the bid was a bit high, it made sense. But then between June 2014 and 2016, the price dropped significantly. It went from $600 to $190, which means Tim lost more than half of his money — something like $15m USD.

Just imagine his situation.

You just drop $20m on a bunch of digital coins and then you lose more than half that money in a few months.

That’s a lot to stomach.

From what I know, Tim didn’t sell any of his bitcoin during this downturn.

The price didn’t move back up towards his initial position until late 2016, where it spiked up past $700, and then back down.

He had to wait two years to get back to the price he bid at.

Fast forward to 2017 — bitcoin’s price soars past 1,000, 5,000, 10,000…and it breaks all expectations and gets up to $20k at the peak. Tim’s $20 million worth of btc turns into more than $700 HUNDRED million btc. That’s quite the return.

If he would have listened to his friends or hesitated back in 2015 and sold at a loss…well, that would have been a real shame, and he would have missed out on making hundreds of millions of dollars.

While not all of us are seasoned tech investors, at minimum we should consider the emotional/mental fortitude that is necessary to push through such losses.

And whether or not bitcoin is cheap is a different question — that’s something you need to decide based on your fundamental analysis, and based on your tolerance for risk.

Happy trading!

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  Parkcoin

Parkcoin  LEO Token

LEO Token  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Uniswap

Uniswap  Official Trump

Official Trump  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  Pepe

Pepe  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Monero

Monero  POL (ex-MATIC)

POL (ex-MATIC)  Cronos

Cronos  OKB

OKB  Mantle

Mantle  Dai

Dai  Algorand

Algorand  Render

Render