The Intersection of Art and Technology: Top 10 Ethereum NFT Assets Revolutionizing Digital Art

Ethereum NFT assets are unique digital assets that are created, bought, sold, and owned on the Ethereum blockchain. NFTs are a type of cryptographic token that represent ownership or proof of authenticity of a particular item, whether it be a piece of artwork, music, video, collectible, virtual real estate, or any other digital or physical object. Unlike cryptocurrencies such as Bitcoin or Ethereum itself, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and unique, each with its own distinct characteristics and value.

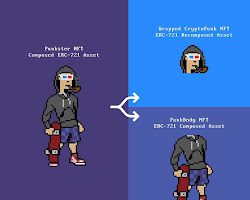

Ethereum, the second-largest blockchain platform after Bitcoin, has gained significant popularity and adoption for hosting NFTs due to its ability to support complex smart contracts and decentralized applications (dApps). NFTs on Ethereum are based on the ERC-721 token standard, although other standards like ERC-1155 are also used for creating NFTs.

One of the key features of Ethereum NFTs is their immutability and traceability. Each NFT has a unique identifier and a record of its ownership history stored on the Ethereum blockchain. This ensures that the ownership and authenticity of an NFT can be easily verified, and no one can counterfeit or duplicate it. The decentralized nature of the blockchain also eliminates the need for intermediaries or centralized authorities to oversee transactions, making it more transparent and secure.

I am very bullish on Web3 gaming.

The fact that we can own our game assets (NFT) is huge.

Vitalik was inspired to create Ethereum for the similar reasons.

When you own your game, you are the part of it, and that is what all players dream.

But it’s just the start 👇

— Singer (@Singer953) February 5, 2023

Creating and owning Ethereum NFT assets usually involves utilizing decentralized applications, often referred to as NFT marketplaces. These platforms allow creators to mint or create NFTs by uploading their digital assets, specifying their desired properties, and generating a unique token. Once minted, these NFTs can be bought, sold, or traded on various marketplaces using Ethereum or other compatible cryptocurrencies.

The value of Ethereum NFT assets is largely determined by factors such as rarity, demand, uniqueness, and the reputation of the creator. Collectors and enthusiasts are often willing to pay significant amounts of money for rare or highly sought-after NFTs. The ownership of an NFT is typically represented by a digital wallet address, and the transfer of ownership is recorded on the Ethereum blockchain through a series of transactions.

Ethereum NFTs have gained significant attention and media coverage due to high-profile sales and unique use cases. Artists, musicians, and celebrities have embraced NFTs as a means to monetize their digital creations directly, without relying on traditional intermediaries. NFTs have also been used for virtual real estate, in-game items, digital fashion, and even tokenizing physical assets such as real estate or artwork.

However, it is important to note that the Ethereum blockchain’s scalability limitations have led to high transaction fees and congestion during periods of high activity, which can pose challenges for widespread adoption and usage of NFTs. Efforts are being made to address these issues through network upgrades, such as Ethereum 2.0, which aims to improve scalability and reduce transaction costs.

In summary, Ethereum NFT assets are unique digital tokens representing ownership or authenticity of specific digital or physical items. They are created, bought, sold, and owned on the Ethereum blockchain, utilizing smart contracts and decentralized applications. Ethereum NFTs have gained popularity for their ability to provide verifiable ownership and facilitate direct peer-to-peer transactions without intermediaries, revolutionizing the way digital assets are valued, bought, and sold.

Also read: Your Ultimate Guide To Ethereum Assets

Use Cases of Ethereum NFT Assets

Ethereum NFT (Non-Fungible Token) assets have a wide range of use cases across various industries and domains. The unique properties of NFTs, such as indivisibility, verifiability, and scarcity, make them suitable for applications where ownership, authenticity, and provenance of digital or physical assets are important. Here are some prominent use cases of Ethereum NFT assets:

1. Digital Art and Collectibles: NFTs have revolutionized the art world by allowing artists to tokenize and sell their digital artworks as unique digital assets. Artists can create limited edition or one-of-a-kind pieces of art, ensuring scarcity and exclusivity. NFTs enable provenance tracking, ensuring that the ownership history and authenticity of the artwork can be easily verified. Digital art marketplaces like SuperRare, OpenSea, and Rarible have gained popularity as platforms for buying, selling, and trading NFT-based digital art and collectibles.

2. Gaming and Virtual Assets: NFTs have found significant applications in the gaming industry, enabling players to own and trade in-game items, characters, and virtual assets. These assets can be bought, sold, and transferred securely using NFTs, providing players with true ownership and the ability to monetize their gaming achievements. Blockchain-based games like Axie Infinity, CryptoKitties, and Decentraland have gained widespread popularity, showcasing the potential of NFTs in the gaming space.

3. Music and Entertainment: NFTs are being used to revolutionize the music and entertainment industry. Musicians can release exclusive music tracks, albums, or concert tickets as NFTs, allowing fans to own unique digital memorabilia. NFTs can provide additional revenue streams for artists, enable direct fan engagement, and provide transparency and traceability for royalty payments. Platforms like Audius and Rarible have emerged as NFT marketplaces for music and entertainment.

4. Virtual Real Estate: NFTs have been used to represent ownership of virtual land, buildings, and properties in virtual worlds or metaverses. Users can buy, sell, and develop virtual real estate, creating unique and immersive experiences. Platforms like Decentraland and The Sandbox offer virtual environments where users can trade NFT-based virtual properties and monetize their creations.

5. Domain Names and Identity: NFTs can be used to represent ownership of domain names, allowing users to buy, sell, and transfer unique internet addresses securely. This creates a decentralized system for managing and trading domain names, eliminating the need for centralized authorities. Additionally, NFTs can be utilized for digital identity management, allowing individuals to prove ownership and control of their digital identity and personal data.

6. Tokenization of Physical Assets: NFTs can be used to tokenize physical assets, such as real estate, luxury goods, and artwork, thereby creating digital representations that can be traded on the blockchain. This enables fractional ownership, liquidity, and efficient transfer of value for traditionally illiquid assets. NFTs provide transparency and provenance, reducing the risk of fraud and facilitating trust in high-value transactions.

These are just a few examples of the diverse range of use cases for Ethereum NFT assets. As the technology continues to evolve, new applications and industries are likely to adopt NFTs to unlock value, establish ownership, and create unique digital experiences.

Also read: What Is Crypto Staking: Top 10 Reasons Ethereum Network Activity Is Soaring

Top 10 Ethereum NFT Assets Revolutionizing Digital Art

Non-fungible tokens (NFTs) have revolutionized the way we think about digital art. These digital assets are unique and cannot be replaced, making them a valuable form of ownership. In recent years, Ethereum has become the leading blockchain for NFTs, and there are now a wide variety of Ethereum NFT assets available.

Here are the top 10 Ethereum NFT assets that are revolutionizing digital art:

1. CryptoPunks

CryptoPunks are a collection of 10,000 unique 24×24 pixel art characters that were created in 2017. They are some of the most popular NFTs in the world, and have sold for millions of dollars. CryptoPunks are a great example of how NFTs can be used to create unique and collectible digital art.

2. Beeple’s “Everydays: The First 5000 Days”

Beeple’s “Everydays: The First 5000 Days” is a collage of 5,000 digital images that were created by Beeple over a period of 13 years. This NFT was sold for a record-breaking $69.3 million in 2021, making it one of the most expensive pieces of digital art ever sold. “Everydays: The First 5000 Days” is a testament to the power of NFTs to create valuable and collectible digital art.

3. NBA Top Shot

NBA Top Shot is a platform that allows fans to collect and trade digital trading cards of NBA highlights. These NFTs are unique and cannot be replaced, making them a valuable way to collect and commemorate NBA history. NBA Top Shot has been a huge success, with over $700 million in trading volume.

4. Bored Ape Yacht Club

Bored Ape Yacht Club is a collection of 10,000 unique NFTs that represent a variety of bored apes. These NFTs have become incredibly popular, and have been sold for millions of dollars. Bored Ape Yacht Club is a great example of how NFTs can be used to create a sense of community and exclusivity.

5. Art Blocks

Art Blocks is a platform that allows artists to create and sell generative art. Generative art is created using algorithms, and each piece is unique. Art Blocks has become a popular platform for artists, and has seen over $1 billion in trading volume.

6. CryptoKitties

CryptoKitties are a collection of 10,000 unique NFTs that represent a variety of cats. These NFTs were some of the first NFTs to gain mainstream attention, and helped to popularize the concept of NFTs. CryptoKitties are still a popular collection, and have been sold for millions of dollars.

7. Meebits

Meebits are a collection of 20,000 unique 3D voxel characters that were created by the same team that created CryptoPunks. Meebits are similar to CryptoPunks in terms of their unique designs, but they also have 3D capabilities. Meebits have been sold for millions of dollars, and are a popular collection among NFT collectors.

8. The Sandbox

The Sandbox is a virtual world that allows users to create, own, and monetize their own experiences. Users can purchase NFTs that represent land, avatars, and other assets in The Sandbox. The Sandbox has become a popular platform for gaming and entertainment, and has seen over $1 billion in trading volume.

9. Axie Infinity

Axie Infinity is a blockchain-based game that allows users to collect, breed, and battle digital pets called Axies. Axies are NFTs, and each one is unique. Axie Infinity has become a popular game in the Philippines, where it has helped to provide a source of income for many people.

10. Sorare

Sorare is a fantasy football game that uses NFTs to represent players.

Benefits of Ethereum NFT Assets

Ethereum NFT (Non-Fungible Token) assets offer several benefits that have contributed to their widespread adoption and popularity. Here are some of the key advantages of Ethereum NFT assets:

1. Ownership and Authenticity: NFTs provide a robust and verifiable system for proving ownership and authenticity of digital or physical assets. Each NFT has a unique identifier and a record of its ownership history stored on the Ethereum blockchain. This ensures that the ownership and provenance of an asset can be easily traced and verified, mitigating the risk of fraud or counterfeit.

2. Scarcity and Exclusivity: NFTs enable the creation of unique digital assets or limited editions, ensuring scarcity and exclusivity. This scarcity drives the value of NFTs, as collectors and enthusiasts seek rare and unique items. NFTs allow creators to assign specific attributes or properties to each asset, making them one-of-a-kind or part of a limited set.

3. Direct Peer-to-Peer Transactions: Ethereum NFTs facilitate direct peer-to-peer transactions without the need for intermediaries. Traditional markets for art, collectibles, and other assets often involve complex intermediaries, such as galleries, auction houses, or licensing agencies. NFTs enable creators to sell their assets directly to buyers, streamlining the transaction process and reducing associated fees.

4. Monetization and Revenue Streams: NFTs provide new avenues for creators and artists to monetize their digital creations. By tokenizing their work as NFTs, creators can sell their assets directly to buyers, eliminating the need for traditional intermediaries. This allows artists to retain more control over their work and generate revenue from the primary and secondary sales of their NFTs.

5. Programmability and Smart Contracts: Ethereum’s smart contract functionality enables programmability and automation of various functions associated with NFTs. Smart contracts can be used to set royalty fees, ensuring that artists receive a percentage of the proceeds whenever their NFTs are resold. Additionally, smart contracts can include additional functionalities like unlocking additional content or features based on certain conditions or events.

6. Interoperability and Standards: Ethereum NFTs adhere to standardized token standards like ERC-721 and ERC-1155, ensuring interoperability across different applications, platforms, and wallets. This means that NFTs created on one platform can be easily transferred, traded, or integrated with other platforms and services, enhancing liquidity and utility.

7. Transparency and Auditability: NFTs are built on the Ethereum blockchain, a decentralized and transparent ledger. The ownership history, transaction details, and metadata associated with each NFT are publicly accessible and cannot be altered. This provides transparency and auditability, instilling trust in the authenticity and ownership of NFT assets.

8. Fractional Ownership and Liquidity: NFTs can be fractionalized, allowing multiple investors to own a fraction of an asset. This enables broader access to high-value assets that were previously out of reach for individual investors. Fractional ownership also enhances liquidity, as these fractions can be traded on secondary markets, enabling investors to buy and sell smaller portions of an asset.

9. Global Reach and Accessibility: Ethereum NFT assets are not limited by geographical boundaries. Anyone with an internet connection and an Ethereum wallet can participate in buying, selling, or trading NFTs. This global reach opens up new markets and opportunities for creators, collectors, and investors worldwide.

It’s important to note that while Ethereum NFT assets offer many advantages, there are also challenges and considerations to be aware of, such as scalability issues, high transaction fees during peak demand, and environmental concerns related to energy consumption. As the technology continues to evolve, addressing these challenges will be crucial for the sustainable growth and long-term viability of Ethereum NFTs.

Also read:How Has Ethereum Network Improved The Adoption Of Crypto Projects

Future of Ethereum NFT Assets

The future of Ethereum NFT assets holds significant potential for further innovation, growth, and adoption. Here are some key aspects that shape the future of Ethereum NFT assets:

1. Enhanced Scalability: Ethereum has been facing scalability challenges, resulting in high transaction fees and network congestion during periods of high activity. To address this, Ethereum is undergoing a major upgrade known as Ethereum 2.0. This upgrade aims to improve scalability through the implementation of a more efficient consensus mechanism (Proof of Stake) and the introduction of shard chains. By increasing the network’s capacity, Ethereum 2.0 will support a larger volume of NFT transactions and foster wider adoption.

2. Improved User Experience: User experience is a critical aspect for the mass adoption of NFTs. Efforts are being made to simplify the process of minting, buying, and selling NFTs, making it more accessible to users with minimal technical knowledge. User-friendly interfaces, better wallet integration, and streamlined transaction processes will contribute to a more seamless and intuitive experience for creators, collectors, and investors.

3. Cross-Chain Interoperability: Interoperability between different blockchain networks is becoming increasingly important for NFTs. Projects like Polkadot, Cosmos, and others are working on cross-chain solutions that enable NFTs to move seamlessly between different blockchains. This interoperability will expand the reach of NFT assets, connect various ecosystems, and increase liquidity by allowing assets to be traded on multiple platforms.

4. Integration with Physical Assets: The convergence of NFTs with physical assets holds great potential. By tokenizing physical assets, such as real estate, luxury goods, or artwork, NFTs can enable fractional ownership, liquidity, and easier transfer of value. NFTs can serve as a bridge between the physical and digital worlds, facilitating trust, provenance, and verification of ownership for real-world assets.

5. Enhanced Utility and Functionality: NFTs are not limited to representing ownership of art or collectibles. In the future, NFTs can have programmable features and additional utility. For example, NFTs can unlock access to exclusive content, grant special privileges in games or virtual worlds, or serve as digital identity representations. The integration of smart contracts and additional functionalities will expand the use cases and value proposition of NFT assets.

6. Tokenization of Intellectual Property: NFTs have the potential to revolutionize intellectual property rights and ownership. Creators can tokenize their intellectual property, such as patents, trademarks, or copyrights, and sell or license them as NFTs. This can create new revenue streams for creators and simplify the management and enforcement of intellectual property rights.

7. Environmental Sustainability: As the popularity of NFTs grows, concerns regarding the environmental impact of the energy consumption associated with blockchain networks, particularly Ethereum, have emerged. The Ethereum community is actively working on addressing these concerns by transitioning to more energy-efficient consensus mechanisms and exploring layer-two scaling solutions. These efforts aim to make Ethereum and NFTs more environmentally sustainable in the long run.

8. Regulatory Landscape: As NFTs continue to gain prominence, regulatory frameworks will likely evolve to address legal and compliance aspects. Governments and regulatory bodies may introduce guidelines or regulations to ensure investor protection, prevent fraud, and address issues related to copyright infringement or money laundering. The establishment of clear and favorable regulations can provide a stable and predictable environment for the growth of NFT assets.

In summary, the future of Ethereum NFT assets looks promising with advancements in scalability, user experience, interoperability, integration with physical assets, utility enhancements, intellectual property tokenization, sustainability efforts, regulatory frameworks, and the continuous innovation within the blockchain ecosystem. As these developments unfold, Ethereum NFTs are expected to become more accessible, valuable, and integral to various industries, unlocking new possibilities for creators, collectors, and investors worldwide.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Avalanche

Avalanche  Stellar

Stellar  Shiba Inu

Shiba Inu  Hedera

Hedera  Toncoin

Toncoin  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Litecoin

Litecoin  WETH

WETH  USDS

USDS  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  MANTRA

MANTRA  Uniswap

Uniswap  Ondo

Ondo  Pepe

Pepe  Aave

Aave  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Official Trump

Official Trump  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Cronos

Cronos  OKB

OKB  POL (ex-MATIC)

POL (ex-MATIC)  Gate

Gate