Strategic Bitcoin Reserve: Will Trump Inauguration Push Bitcoin to $500,000?

We’re getting closer to Trump’s inauguration and Bitcoin is once again dominating headlines, with its price holding steady above $100,000.

Talks of a U.S. strategic Bitcoin reserve, growing institutional interest, and new regulatory shifts all contribute to Bitcoin’s bullish momentum. But can Bitcoin reach $500,000 this year?

As the market heats up, new projects like PlutoChain ($PLUTO) could step in to potentially tackle Bitcoin’s limitations by offering faster transactions and advanced Layer-2 functionalities.

Below, we’ll cover all the relevant details.

Will Bitcoin Skyrocket to $500,000 Post Trump Inauguration? Closer Look at Technical Charts

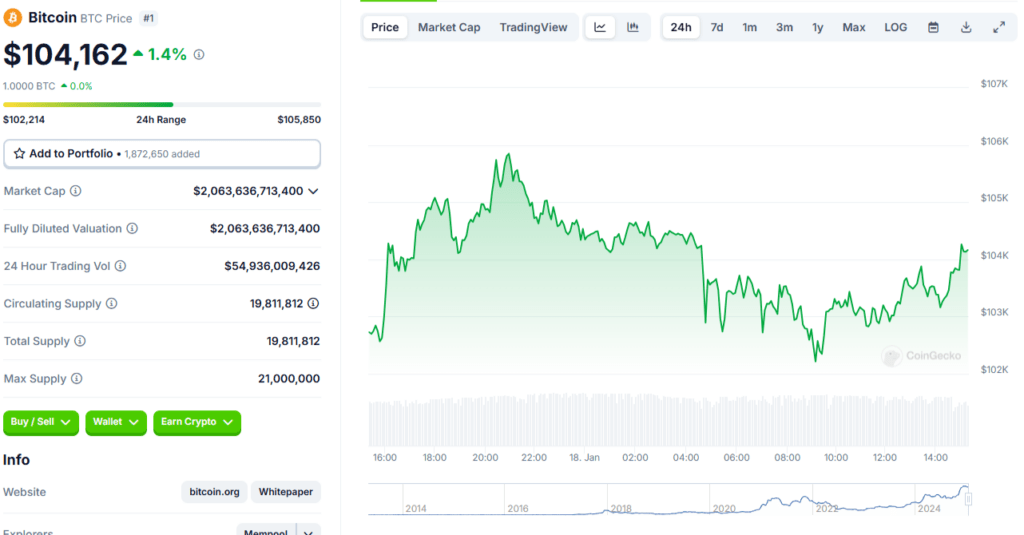

As of January 18, 2025, Bitcoin is holding strong at $104,162, with a massive market capitalization of around $2.06 trillion.

Over the past 24 hours, its trading volume has reached an impressive $54.94 billion.

Bitcoin’s all-time high was recently achieved in mid-December 2024 when it soared to approximately $108,000.

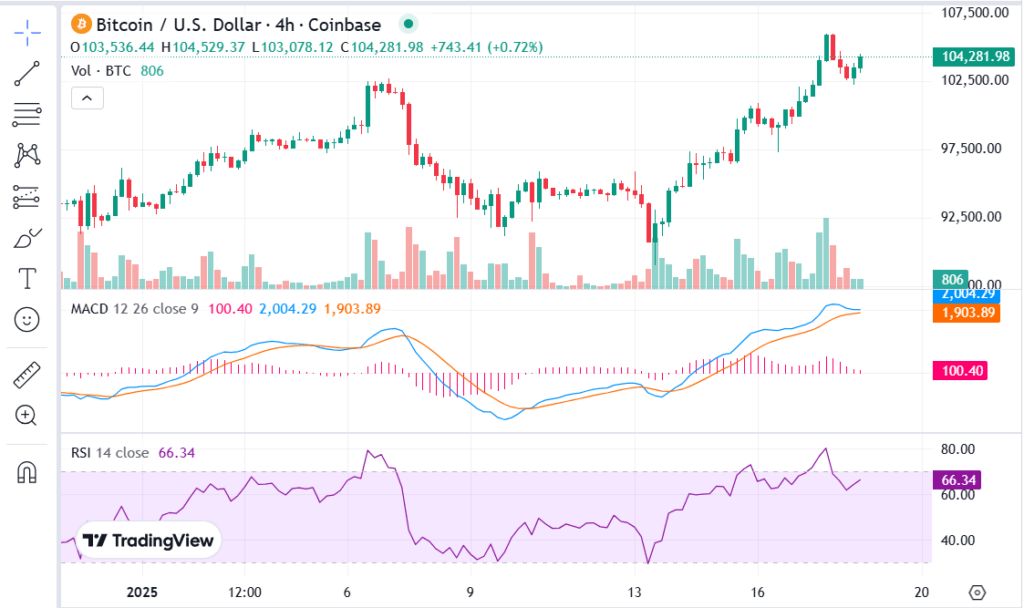

Since then, its price has been navigating key support and resistance levels. The support zones are currently identified at $92,000, $87,000, and $74,000, while resistance is being tested at $100,000 and $106,000.

The RSI is at 66 right now, which signals that the market is leaning toward bullish momentum but hasn’t yet entered overbought territory.

Interestingly, Bitcoin’s involvement in decentralized finance (DeFi) is also growing. Its total value locked (TVL) in DeFi projects has now surpassed $1 billion.

Speculation about Bitcoin’s future is heating up with talks of the U.S. creating a strategic Bitcoin reserve.

President-elect Donald Trump, set to take office on January 20, 2025, has shown a pro-crypto stance and plans to establish the reserve, which would position the U.S. as a leader in digital assets.

This concept isn’t entirely new. In July 2024, U.S. Senator Cynthia Lummis introduced a bill proposing the creation of a strategic Bitcoin reserve, suggesting the purchase of up to one million bitcoins over five years.

Advocates argue that holding Bitcoin could help shield the U.S. economy from inflation, diversify monetary strategies, and maintain competitiveness in the blockchain revolution.

Internationally, countries like El Salvador have already embraced Bitcoin, and companies such as MicroStrategy have demonstrated the value of substantial Bitcoin reserves.

Institutional interest in Bitcoin has also surged. In January 2024, the U.S. Securities and Exchange Commission approved multiple spot Bitcoin exchange-traded funds (ETFs).

Galaxy Digital’s CEO predicts Bitcoin could reach $500,000 if the reserve is established.

VirtualBacon, an analyst on X, predicts that Bitcoin will reach $200,000 by the end of the year, thanks to increased Fed liquidity, pro-crypto policies, ETF inflows, and an anticipated altcoin season.

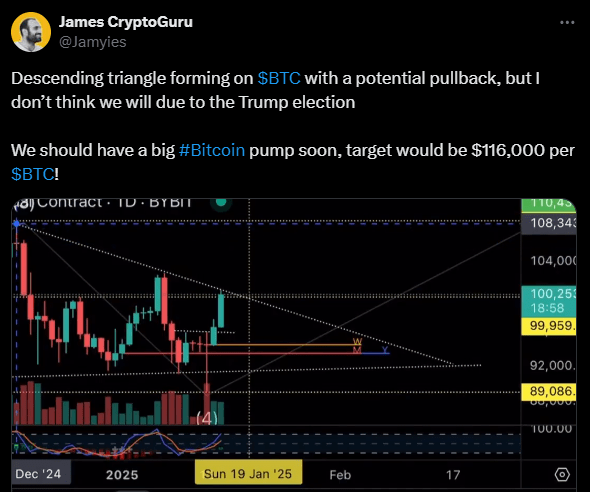

Another analyst James CryptoGuru predicts a potential Bitcoin pump to $116,000, despite a descending triangle pattern suggesting a pullback, influenced by the upcoming Trump election.

PlutoChain ($PLUTO) Is a Layer-2 Solution That Could Upgrade Bitcoin for DeFi, NFTs, and Advanced Blockchain Applications

Bitcoin users often encounter slow transactions, high fees, and network congestion.

PlutoChain ($PLUTO) could address these issues with its hybrid Layer-2 solution, by creating a parallel network that could reduce traffic, lower fees, and improve scalability.

PlutoChain’s Layer-2 technology offers block times of 2 seconds – a major improvement over Bitcoin’s 10-minute blocks.

This could support efficient smart contract execution while maintaining Bitcoin’s trusted infrastructure.

EVM compatibility could allow developers to seamlessly port Ethereum-based projects to PlutoChain. This could create new opportunities for DeFi, NFTs, and AI applications, and broaden Bitcoin’s use cases beyond its role as a store of value.

To ensure top-notch security, PlutoChain has undergone audits by SolidProof, QuillAudits, and Assure DeFi. The team conducts regular code reviews, and stress tests, and adheres to international standards for added reliability.

Furthermore, users can vote on upgrades, partnerships, and features through the official Discord channel. This way PlutoChain fosters transparency and engagement.

During the testnet phase, PlutoChain has processed 43,200 transactions in one day without congestion. This performance showcases its readiness for real-world applications.

The Bottom Line

With Trump’s inauguration just days away, there’s a lot of optimism around Bitcoin’s potential.

Speculation around a U.S. strategic Bitcoin reserve, institutional interest, and regulatory shifts could help the crypto giant reach new heights in the next few months.

At the same time, PlutoChain’s ($PLUTO) could help overcome Bitcoin’s long-standing limitations.

By reducing fees, offering faster transaction speeds, and enabling advanced functionalities, PlutoChain might position Bitcoin as a more competitive platform in decentralized finance.

– – ————

The information in this article does not represent financial or investment advice. Always research carefully before participating in the crypto market. Risks are inherent in forward-looking statements, which may not be revised.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  Parkcoin

Parkcoin  LEO Token

LEO Token  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  Official Trump

Official Trump  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  Pepe

Pepe  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  Monero

Monero  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Algorand

Algorand  Cronos

Cronos  OKB

OKB  Dai

Dai  Render

Render  MANTRA

MANTRA