Regulating the Risks of Artificial Intelligence: Binance Disables Trading Of Privacy Tokens

The regulatory landscape surrounding artificial intelligence (AI) continues to evolve as stakeholders prioritize mitigating its potential negative impacts. Recent developments highlight global efforts including Binance aimed at addressing the risks associated with AI.

In a notable move, several AI experts, including the CEOs of OpenAI, Google DeepMind, and Anthropic, issued a joint statement emphasizing the need to consider the risk of AI-driven extinction as a global priority, alongside other significant societal-scale threats such as pandemics and nuclear war.

Countries like China have initiated discussions on enhancing governance in digital data and AI, with President Xi Jinping and influential members of the Communist Party engaging in these conversations. The Australian government has also taken action by launching an eight-week consultation to evaluate the potential banning of “high-risk” AI tools.

In an innovative approach to the dialogue, Italian Senator Marco Lombardo delivered a speech entirely generated by OpenAI’s ChatGPT-4, showcasing the integration of AI technology into legislative processes. The senator trained the chatbot with the draft law of the Italian-Swiss agreement on cross-border workers, incorporating recent developments on the subject.

Japan’s government AI strategy council has drawn attention to the lack of legislation protecting copyright in the context of AI. Additionally, the Personal Information Protection Commission has called for OpenAI to minimize the collection of sensitive data for machine learning purposes. Notably, local politicians in Japan have expressed support for AI, with Chief Cabinet Secretary Hirokazu Matsuno even suggesting the incorporation of AI technology into government systems.

Also, read – OpenAI Commits $1 Million To Support AI-Driven Cybersecurity Initiatives

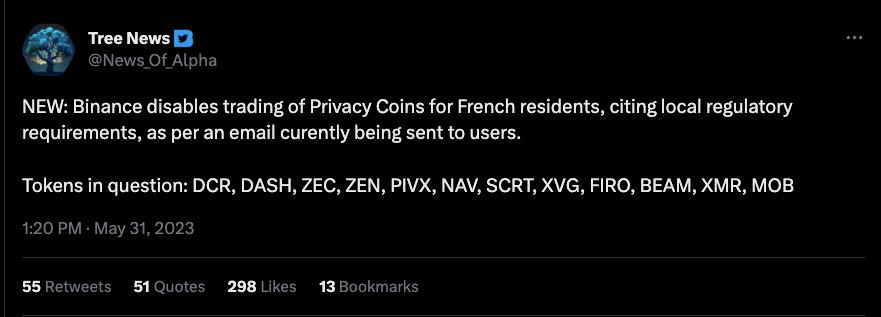

Binance has announced plans to delist privacy tokens in France, Italy, Poland, and Spain

In another realm of regulation, Binance, a major cryptocurrency exchange, has announced plans to delist privacy tokens, including Monero (XMR) and Zcash (ZEC), for customers in France, Italy, Poland, and Spain, in compliance with local laws and regulations.

Furthermore, European Union officials have signed the Markets in Crypto-Assets (MiCA) regulatory framework into law. This framework, introduced by the European Commission three years ago, is expected to come into effect following publication in the Official Journal of the European Union, with key regulations for crypto firms likely to commence in 2024.

In the United States, lawmakers from the House Financial Services Committee and House Agriculture Committee have proposed a draft bill that aims to limit the power of the Securities and Exchange Commission (SEC) in relation to digital assets. The bill offers certain crypto assets a pathway to being classified as digital commodities, prohibiting the SEC from denying registration to digital asset trading platforms operating as regulated alternative trading systems.

The draft bill also introduces criteria for digital assets to qualify as decentralized and functional, requiring the SEC to provide a detailed analysis when objecting to a firm’s decentralized classification.

Overall, these regulatory efforts illustrate the ongoing commitment to address the risks associated with AI and cryptocurrencies, aiming to strike a balance between innovation and protection in the evolving technological landscape.

All about Binance and its regulations regarding trading

Binance is one of the largest cryptocurrency exchanges in the world, but it has also been the subject of much regulatory scrutiny. In recent years, Binance has been fined by regulators in several countries, and it has been banned from operating in others.

In the United States, Binance is not currently licensed to operate by any federal or state regulators. However, it does have a subsidiary, Binance.US, which is registered with the Financial Crimes Enforcement Network (FinCEN) as a money services business. Binance.US is not allowed to offer margin trading or derivatives trading to US customers.

In other parts of the world, Binance has a more mixed regulatory record. For example, Binance is licensed to operate in Japan, Malta, and the Cayman Islands. However, it has been banned from operating in China, South Korea, and Ontario, Canada.

Binance has said that it is committed to complying with all applicable regulations. However, the company’s regulatory troubles have raised concerns about its long-term viability.

Here are some of the key regulations that apply to Binance trading:

- Anti-Money Laundering (AML) regulations: Binance is required to comply with AML regulations in all jurisdictions where it operates. This includes identifying and verifying the identity of its customers, and reporting suspicious activity to law enforcement.

- Know Your Customer (KYC) regulations: Binance is required to collect certain information from its customers, including their name, address, and date of birth. This information is used to verify their identity and to prevent fraud.

- Foreign Account Tax Compliance Act (FATCA) regulations: Binance is required to report information about its US customers to the Internal Revenue Service (IRS). This information includes the customer’s name, address, and tax identification number.

Binance users should be aware of the risks associated with trading on the platform. These risks include:

- Market volatility: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. This can lead to losses for traders.

- Security risks: Cryptocurrency exchanges are often targeted by hackers. This can lead to the theft of user funds.

- Regulatory risks: The cryptocurrency industry is still in its early stages, and regulations are constantly evolving. This can make it difficult for exchanges to comply with all applicable laws.

Despite the risks, Binance can be a good place to trade cryptocurrencies. The platform offers a wide variety of features, including margin trading, derivatives trading, and staking. However, users should carefully consider the risks before trading on Binance.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Polkadot

Polkadot  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Hyperliquid

Hyperliquid  Uniswap

Uniswap  Official Trump

Official Trump  Wrapped eETH

Wrapped eETH  Pepe

Pepe  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Monero

Monero  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Dai

Dai  Algorand

Algorand  MANTRA

MANTRA  OKB

OKB