Top 10 Amazing Potential of Real-World Assets in DeFi: Clearing All The Hype vs. Reality

The world of Decentralized Finance (DeFi) has been abuzz with the concept of “real world assets” entering the digital realm. But are these real-world assets in DeFi just another trendy buzzword, or do they represent a fundamental shift in the financial landscape? In this article, we’ll explore what real-world assets in DeFi mean, their significance, and the challenges they bring to the decentralized finance space.

Understanding Real World Assets in DeFi

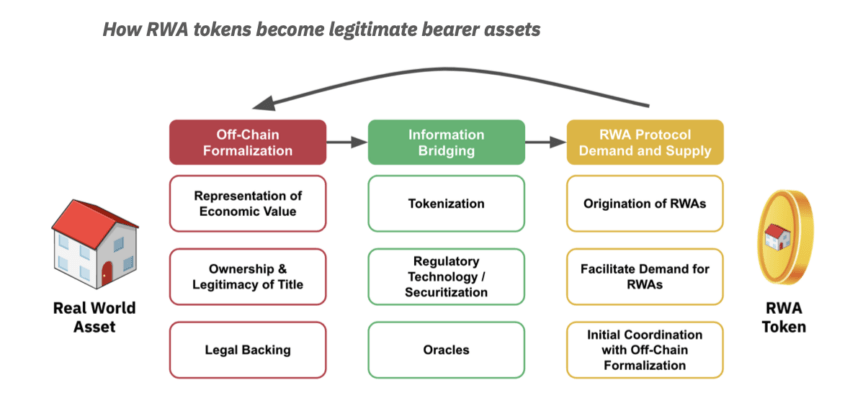

Real world assets, in the context of DeFi, refer to tangible and physical assets such as real estate, stocks, bonds, and commodities that are traditionally traded in the traditional financial system. The idea behind incorporating these assets into the DeFi ecosystem is to bridge the gap between the decentralized blockchain world and the established financial markets.

The process of bringing real-world assets into DeFi typically involves tokenization. Tokenization is the representation of these assets as digital tokens on a blockchain, usually in the form of security tokens or tokenized assets. These tokens are backed by real-world assets and can be traded, lent, or used as collateral within DeFi platforms.

Significance of Real World Assets in DeFi

The integration of real-world assets into the world of Decentralized Finance (DeFi) is a groundbreaking development with far-reaching implications. It introduces tangible, physical assets like real estate, stocks, bonds, and commodities into the digital and decentralized realm of blockchain. Here are the top 10 significances of real-world assets in DeFi:

1. Enhanced Liquidity

Real-world assets, such as real estate or art, are traditionally illiquid investments. By tokenizing these assets and bringing them into the DeFi space, they become more liquid and divisible. This increased liquidity opens up new investment opportunities and allows for more efficient capital allocation.

2. Fractional Ownership

Tokenization enables fractional ownership of real-world assets. Investors can purchase fractions of an asset, making high-value investments accessible to a broader range of individuals. This democratizes access to assets that were previously out of reach for many.

3. Global Accessibility

Real-world assets tokenized on blockchain networks are accessible to anyone with an internet connection. There are no geographical restrictions or time zone limitations. This accessibility fosters a global marketplace for assets, allowing investors from around the world to participate 24/7.

4. Transparency and Trust

Blockchain technology ensures transparency and immutability. Ownership records and transaction histories of tokenized assets are securely stored on the blockchain, reducing fraud and improving trust in the authenticity of assets and their provenance.

5. Efficiency and Automation

Smart contracts can automate various processes related to real-world assets. For example, dividend payments, interest calculations, and asset management can all be executed automatically through code. This reduces the need for intermediaries and streamlines operations, reducing costs and increasing efficiency.

6. DeFi Integration

Real-world asset tokens can be seamlessly integrated into DeFi platforms. This means that these assets can be used as collateral for loans, staked in liquidity pools, and utilized in yield farming strategies. DeFi users can leverage these assets to generate yield and access various financial services.

7. Risk Diversification

Investors can diversify their portfolios by including real-world assets alongside cryptocurrency-based investments. This diversification can help mitigate risk, as real-world assets often have different risk profiles than cryptocurrencies.

8. Improved Accessibility to Traditional Assets

Tokenization enables direct access to traditional assets like stocks and bonds without the need for intermediaries or complex processes. Investors can buy, sell, and trade these assets in a decentralized manner, reducing fees and administrative hurdles.

9. Regulatory Compliance

Efforts are being made to ensure that tokenized real-world assets comply with existing regulations, including securities laws and Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This regulatory compliance is crucial for the legitimacy and widespread adoption of these assets in DeFi.

10. New Investment Opportunities

The introduction of real-world assets into DeFi creates new investment opportunities and expands the types of assets available to investors. It allows for innovative financial products and services that blend traditional finance with the advantages of blockchain technology.

Real-world assets in DeFi represent a significant shift in the financial landscape. They provide enhanced liquidity, fractional ownership, global accessibility, transparency, and automation, all while expanding the range of available assets. While challenges like regulatory compliance and data accuracy must be addressed, the integration of real-world assets into DeFi has the potential to democratize finance and create a more inclusive and efficient global financial ecosystem.

In today’s review, we take an in-depth look at Maple (@maplefinance), a remarkable project at the intersection of DeFi and Real World Assets (RWA).

We’ll explore how Maple’s credit experts are reshaping lending with Real-World Assets.

Let’s start it 👇 pic.twitter.com/fhcmopD4Nj

— slatro.eth (@slatro_eth) September 21, 2023

Top 10 Potential of Real-World Assets in DeFi: Hype vs. Reality

The world of Decentralized Finance (DeFi) has been abuzz with the concept of real-world assets (RWAs) entering the digital realm. But is this just another trendy buzzword, or does it represent a fundamental shift in the financial landscape? Let’s dive deep into the top 10 potential benefits of RWAs in DeFi, along with a reality check to understand the current state and challenges.

Top 10 Potential Benefits of RWAs in DeFi:

-

Enhanced Liquidity: Traditional assets like real estate or art are notoriously illiquid, meaning they can’t be easily bought or sold. By tokenizing these assets (representing them as digital tokens on a blockchain), DeFi unlocks new levels of liquidity. Imagine fractional ownership of a Manhattan apartment building or a Picasso painting, allowing smaller investors to participate in previously inaccessible asset classes.

-

Fractional Ownership: Tokenization allows for the division of ownership of a real-world asset into smaller, tradable units. This opens doors for a broader investor base. Imagine co-owning a vacation rental property in Bali with friends through DeFi tokens, spreading the investment cost and potential returns.

-

Improved Accessibility: DeFi removes geographical barriers to entry. Traditionally, investing in certain assets might require physical presence or specific licenses. With DeFi, anyone with an internet connection could potentially invest in a vineyard in Napa Valley or a commercial building in London through tokenized ownership.

-

Streamlined Transactions: DeFi smart contracts automate many manual processes involved in traditional asset transactions. Imagine faster settlement times and reduced paperwork for buying and selling tokenized real estate compared to the traditional closing process.

-

** Democratization of Investment Opportunities:** DeFi empowers individuals to build their own diversified portfolios with a wider range of assets beyond just stocks and bonds. This financial inclusion can potentially close the wealth gap by allowing everyone to participate in traditionally exclusive investment opportunities.

-

Transparency and Traceability: Blockchain technology provides a transparent and immutable record of ownership for tokenized assets. This can reduce fraud and increase trust in the investment process. Imagine a clear and verifiable chain of ownership for a tokenized piece of rare artwork, eliminating concerns about forgeries.

-

New Investment Products: The integration of RWAs opens doors for innovative DeFi products. Imagine decentralized investment funds managed by DAOs (Decentralized Autonomous Organizations) that invest in a basket of tokenized real estate or infrastructure projects.

-

Efficient Fractional Lending: DeFi allows for fractional lending of tokenized assets. Imagine using a tokenized rental property as collateral for a loan, with the loan repayments automatically distributed to token holders based on their ownership percentage.

-

Global Reach for Businesses: Companies seeking capital can leverage DeFi to raise funds through tokenized offerings of their assets. This global reach can connect them with a wider pool of potential investors beyond traditional financial institutions.

-

Potential for Increased Efficiency: DeFi can potentially streamline various aspects of asset management, such as dividend distribution, voting rights management, and compliance processes, through the use of smart contracts.

Reality Check: Hype vs. Implementation

While the potential of RWAs in DeFi is undeniable, there are significant hurdles to overcome before widespread adoption becomes a reality:

-

Regulation: The regulatory landscape surrounding tokenized securities and DeFi platforms is still evolving. Regulatory uncertainty can hinder innovation and discourage traditional financial institutions from entering the space.

-

Liquidity Challenges: While DeFi unlocks new avenues for liquidity, creating deep and liquid markets for all tokenized RWAs might take time. Early investors might face challenges entering or exiting positions due to a lack of established markets for certain asset classes.

-

Smart Contract Security: DeFi platforms are susceptible to hacks and exploits. Ensuring the security of smart contracts that manage tokenized RWAs is crucial for building trust and attracting investors.

-

Valuation and Price Discovery: Determining the fair market value of tokenized RWAs, especially for unique assets like art, can be challenging. Traditional valuation methods might not translate perfectly to the DeFi space.

-

Integration with Traditional Finance: Bridging the gap between DeFi and traditional finance is essential for mainstream adoption. Collaboration between regulators, DeFi platforms, and established institutions is needed to create a smooth and secure environment for RWAs.

The integration of RWAs in DeFi holds immense potential to transform the financial landscape. By overcoming the challenges and fostering collaboration, we can unlock a future where traditional assets are more accessible, investment opportunities are more democratized, and financial transactions are more efficient and transparent. While there’s still hype surrounding this nascent space, the potential benefits are undeniable, making RWAs in DeFi a trend worth watching closely.

Challenges and Considerations

While real-world assets in DeFi hold great promise, they also present several challenges and considerations:

1. Regulatory Compliance

Bringing real-world assets into the DeFi ecosystem requires navigating complex regulatory landscapes. Compliance with securities laws and Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is crucial.

2. Oracles and Data Feeds

Oracles, which provide off-chain data to smart contracts, are essential for verifying real-world events (e.g., asset prices). Ensuring the accuracy and reliability of oracles is a critical challenge.

3. Custody Solutions

Secure custody solutions are needed to safeguard real-world assets tokenized on blockchain. This involves robust security measures to protect against theft or loss.

4. Cross-Chain Compatibility

Ensuring interoperability between different blockchain networks is vital for the efficient transfer and use of real-world asset tokens.

5. Market Acceptance

Real-world asset tokenization is still in its early stages, and widespread market acceptance may take time to develop.

Also, read – 3 Reasons Why GameFi, DeFi And SocialFi Are Horizontals In Metaverse

Conclusion

Real-world assets in DeFi are more than just a buzzword; they represent a significant evolution in the DeFi space. The ability to tokenize and trade real-world assets on blockchain networks has the potential to reshape how we invest, access liquidity, and manage assets. However, addressing regulatory challenges, ensuring data accuracy, and building secure custody solutions are critical to realizing the full potential of real-world assets in DeFi.

As the DeFi ecosystem continues to mature and regulatory frameworks evolve, we can expect to see a growing integration of real-world assets into decentralized finance platforms. This convergence of traditional finance and blockchain technology has the potential to create a more inclusive, efficient, and globally accessible financial ecosystem.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Hedera

Hedera  WETH

WETH  Polkadot

Polkadot  Stellar

Stellar  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Pepe

Pepe  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  NEAR Protocol

NEAR Protocol  USDS

USDS  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Render

Render  MANTRA

MANTRA  Dai

Dai  Virtuals Protocol

Virtuals Protocol  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum