Pepe Price Prediction: Pepe Coin Is in Danger With Massive Sell-Offs While PlutoChain Gets Whale Attention

Pepe Coin is hitting a rough patch, with whale sell-offs causing concern and predictions of a downturn gaining traction – a topic we’ll explore further.

At the same time, PlutoChain ($PLUTO) could stand out with its powerful Layer-2 approach to improving Bitcoin’s ecosystem.

This Layer-2 solution could transform Bitcoin by potentially making transactions instant, cutting costs, adding Ethereum compatibility, tackling scalability issues, and boosting real-world use.

Let’s explore this further.

Pepe Price Prediction: Pepe Coin Faces Uncertainty as Whale Sell-Offs Spark Concern

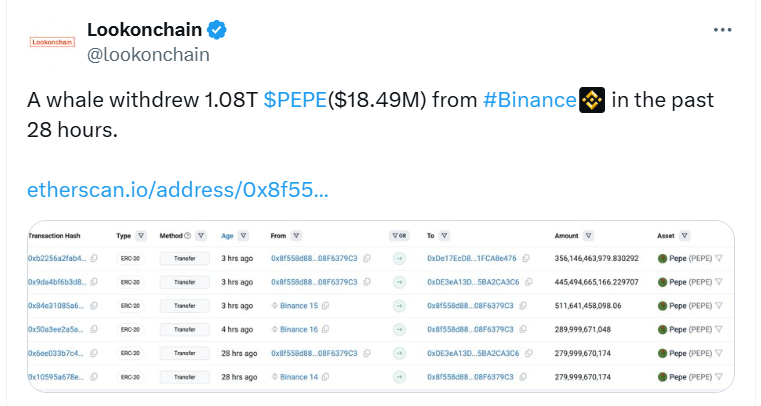

Pepe Coin has been facing market instability lately, mainly due to large sell-offs by big whales. One major transaction saw a whale withdraw 1.08T PEPE tokens. This influx of tokens contributed to a sharp 17% price decline within just 24 hours.

According to an X user tbag, a dormant Pepe Coin whale has recently moved $5.73 million worth of PEPE to Coinbase after six months of inactivity, potentially signaling a shift in market activity.

Currently, Pepe Coin (PEPE) is priced at around $0.00001002, showing a slight decline of about 1.96% over the last 24 hours.

The 14-day Relative Strength Index (RSI) stands at 31.19, indicating that the coin is getting close to being oversold, which could suggest the potential for price recovery if demand picks up.

How PlutoChain’s Hybrid Layer-2 Solution Might Enhance Bitcoin’s Performance and Speed

PlutoChain ($PLUTO) may present a promising solution to some of Bitcoin’s biggest issues, such as slow transaction speeds and high operational costs. PlutoChain offers a 2 second block time compared to Bitcoins standard 10 minute block time.

A key feature of PlutoChain is its compatibility with Ethereum’s Virtual Machine (EVM), which could allow developers to easily move projects between networks.

This ability could expand Bitcoin’s capabilities and connect it to a wider ecosystem of decentralized applications (dApps) and smart contracts, offering more flexibility and paving the way for new features.

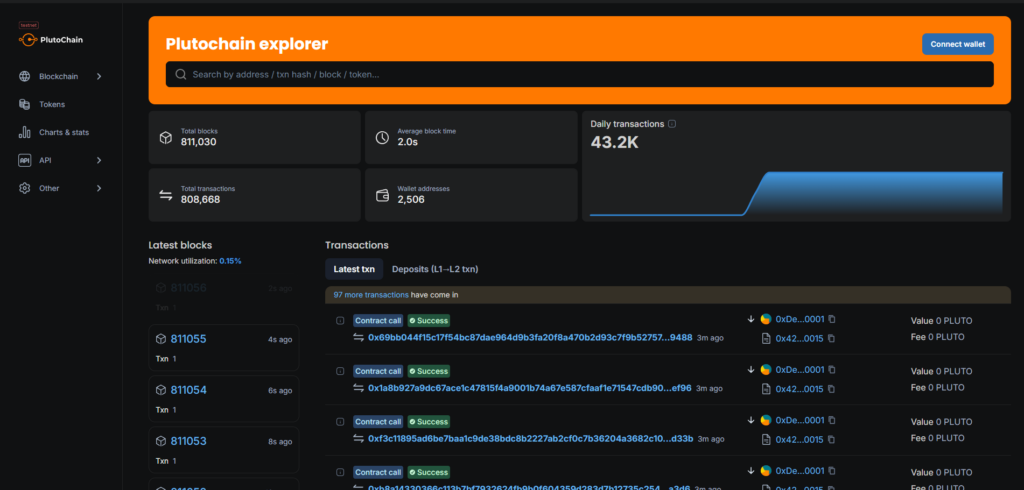

Early tests have been encouraging, with PlutoChain already processing over 43,200 transactions per day. This shows its potential to handle large transaction volumes and support a global network.

Security is another strong point, with PlutoChain working with trusted auditing firms like SolidProof, QuillAudits, and Assure DeFi to ensure the platform’s reliability. These audits help verify the integrity of its technology and build trust in its future prospects.

Additionally, PlutoChain’s governance model lets users vote on key decisions, giving the community a say in the platform’s ecosystem growth and direction.

By addressing Bitcoin’s infrastructure challenges, PlutoChain could make Bitcoin more practical for everyday transactions. With faster speeds, lower fees, and stronger Ethereum compatibility, PlutoChain could unlock greater potential for the Bitcoin network.

The Bottom Line

As Pepe Coin faces uncertainty, other projects like PlutoChain ($PLUTO) could start gaining traction in the upcoming weeks.

By offering faster transactions, lower fees, and Ethereum compatibility, PlutoChain might solve Bitcoin’s long-standing scalability issues.

– – –

Remember, this article is not financial or trading advice. All cryptocurrencies are volatile, and past performance is not a guarantee of future results. Always conduct your own research and/or consult with experts before making any crypto-related decisions. Trade responsibly. Forward-looking statements are uncertain and might not be updated.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  MANTRA

MANTRA  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC