Over $200 Billion In Market Cap Wiped as Investors Hedge Bets in Ethereum, Solana, and Chainlink

With June nearing the end, the market is facing a significant shakeup as over $200 billion in market cap has been wiped out quickly. Investors are hedging their bets, causing notable declines in major altcoins like Ethereum (ETH), Solana (SOL), and Chainlink (LINK).

Ethereum Price Dips By 5.22% With $400B+ Market Cap

Ethereum (ETH), the second-largest cryptocurrency by market cap, has not been safe amid the recent market downturn. Currently priced at $3,310, Ethereum has seen a 5.22% drop in the last 24 hours, bringing its market cap down to $404.77 billion.

The −41.4 MACD level indicates a bearish trend, reflecting the broader market sentiment. Ethereum’s recent performance shows investors’ skeptical approach amid current conditions. Despite the price drop, Ethereum’s trading volume surged by 146.90%, reaching $16.55 billion in the same period.

Solana (SOL) Displays Bearish Outlook After 5.49% Drop

The recent market movements have also impacted Solana (SOL). With a current price of $126.49, Solana has dropped by 5.49% in the past 24 hours. Its −8.57 MACD level supports Solana’s bearish outlook. Despite the recent downturn, Solana’s strong fundamentals and blockchain technology still own investor confidence, making it a hot pick in the market.

Its market cap is now at $58.51 billion. However, similar to Ethereum, Solana has dramatically surged in trading volume, with a 200.88% surge, bringing the total to $2.18 billion.

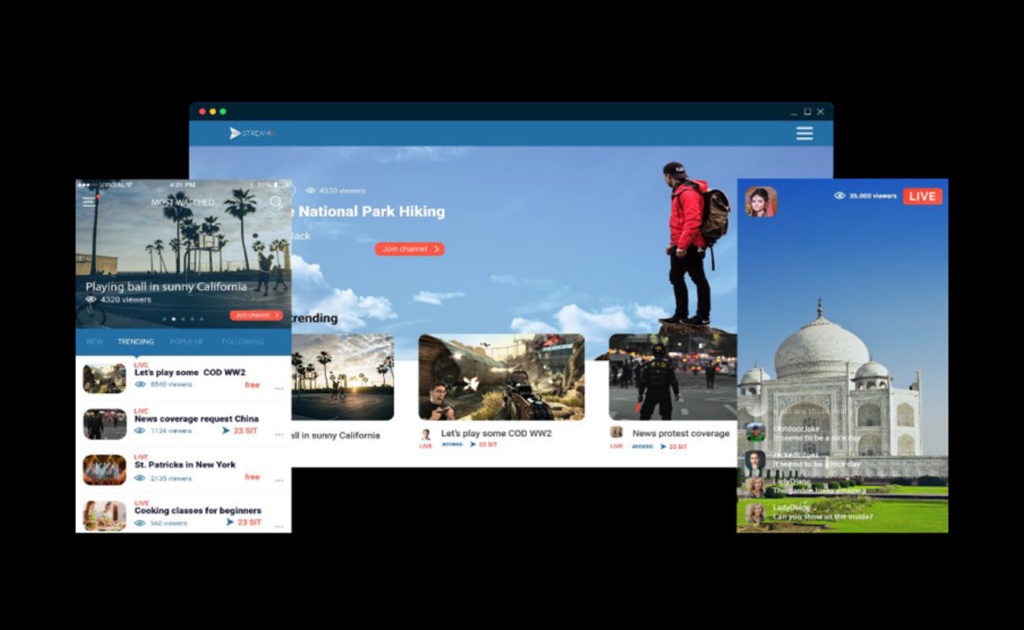

DTX Exchange Gains Traction With Access To 120,000+ Assets

With the crypto market experiencing these fluctuations, traders are hopping to platforms that offer lucrative trading capabilities and features. DTX Exchange is the ultimate hybrid trading platform designed to meet the demands of today’s high-stakes market environment. With access to over 120,000 assets across crypto.

DTX offers distributed liquidity pools, up to 1000X leverage, and non-custodial wallets. These features empower traders to maximize their positions and manage their portfolios with greater efficiency and control. Furthermore, the project does not demand KYC requirements, delivering a hassle-free trading experience and attracting a global audience.

Chainlink (LINK)’s Trading Volume Surges By 57.22%

Chainlink (LINK) has fared slightly better than Ethereum (ETH) and Solana (SOL) but has still been affected by the market’s turbulence. Currently priced at $13.15, Chainlink has dropped 2.68% in the last 24 hours. Its market cap is now at $7.99 billion. The trading volume for Chainlink has increased by 57.22%, reaching $276.22 million.

The MACD level of −0.833 indicates a less pronounced but still negative trend. Chainlink’s ability to maintain relatively stable performance amidst broader market declines exhibits its cutting-edge blockchain and community support.

Investors Pump DTX Tokens For Its Advanced Trading Tools

DTX equips traders with a wealth of charts, graphs, and analytical tools, allowing for informed decision-making and strategic planning. The platform’s support for quantitative and algorithmic trading further enhances its appeal, enabling users to automate their strategies and execute trades precisely.

With the current market volatility, DeFi platforms like DTX offer stability and lucrative opportunities. Integrating advanced trading tools and compliance measures positions DTX as a leading choice for traders looking to generate 25x gains in the crypto space. The network recently announced a grand blockchain integration with new features and upgraded security.

Learn more:

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Sui

Sui  WETH

WETH  Pepe

Pepe  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Polkadot

Polkadot  NEAR Protocol

NEAR Protocol  Aptos

Aptos  Litecoin

Litecoin  Wrapped eETH

Wrapped eETH  USDS

USDS  Uniswap

Uniswap  Cronos

Cronos  Stellar

Stellar  Internet Computer

Internet Computer  Bittensor

Bittensor  dogwifhat

dogwifhat  Dai

Dai  Ethereum Classic

Ethereum Classic  WhiteBIT Coin

WhiteBIT Coin  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Ethena USDe

Ethena USDe  POL (ex-MATIC)

POL (ex-MATIC)  Monero

Monero  Stacks

Stacks  OKB

OKB  Render

Render  Hedera

Hedera  Bonk

Bonk  Mantle

Mantle  Filecoin

Filecoin