Top 5 Intriguing Reasons Why Layer 2 Centralization is a Ticking Time Bomb for Blockchain

Blockchain technology, with its decentralized ethos and promise of trustless interaction, has revolutionized industries ranging from finance to supply chain management. At its core, blockchain strives to decentralize control, remove intermediaries, and offer transparent, immutable ledgers that empower users and developers alike. However, as blockchain systems grow in complexity and scale, the push to solve problems such as network congestion, high transaction fees, and limited throughput has led to the development of Layer 2 (L2) solutions. These solutions, while efficient and necessary for scaling, may come with significant risks—particularly the risk of centralization.

The rise of Layer 2 technologies is a testament to the need for faster, cheaper, and more efficient blockchains. But in the pursuit of scalability, many L2 solutions are starting to centralize control and governance, directly contradicting the decentralized vision that blockchain technology was built upon. This article explores why L2 centralization is a ticking time bomb for blockchain, how it could threaten the very essence of decentralization, and what potential risks it poses for the future of the industry.

Understanding Blockchain Layers

Before diving into the centralization problem on Layer 2, it’s essential to understand the distinction between Layer 1 (L1) and Layer 2.

Layer 1 (L1)

Layer 1 refers to the base layer of a blockchain, the primary network that operates independently and is responsible for all the core functions such as consensus mechanisms, token issuance, and transaction validation. Bitcoin and Ethereum are examples of Layer 1 blockchains.

These L1 blockchains are designed to be decentralized, with control distributed among thousands of nodes that participate in the consensus process. The goal of Layer 1 is to provide a secure, immutable, and censorship-resistant foundation for transactions and smart contracts.

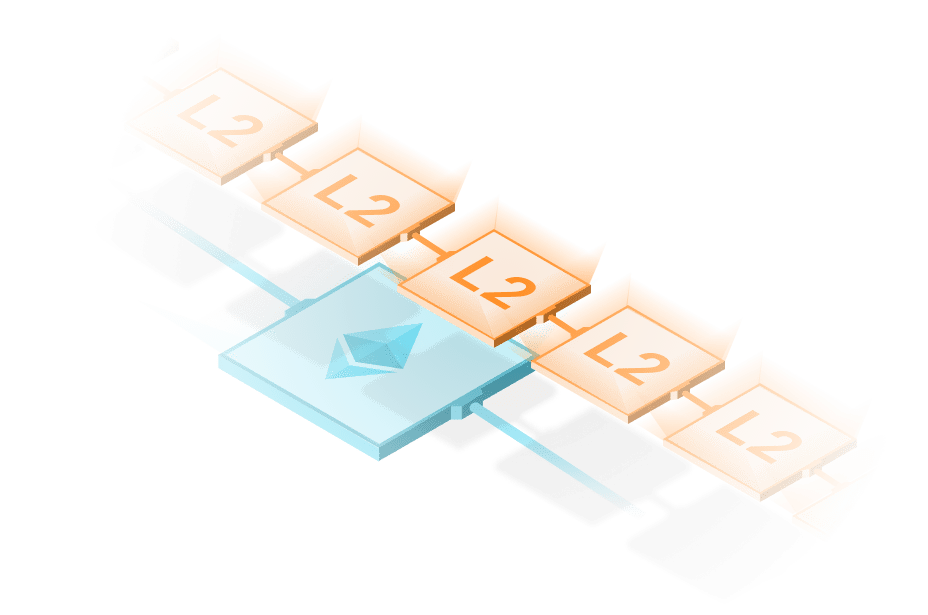

Layer 2 (L2)

Layer 2 solutions are built on top of existing Layer 1 blockchains and aim to improve scalability, reduce transaction fees, and increase throughput. Examples of Layer 2 solutions include the Lightning Network for Bitcoin and rollups (such as Optimistic Rollups and zk-Rollups) for Ethereum.

L2 technologies offload some of the transaction processing from the main chain (L1), allowing for faster and cheaper transactions. Once these transactions are processed on the L2 network, they are periodically consolidated and recorded on the Layer 1 blockchain to ensure security and immutability.

While Layer 2 has emerged as a vital tool for scaling blockchain, it also introduces a potential Achilles heel—centralization.

The Benefits of L2 Solutions

Layer 2 solutions bring multiple benefits to the blockchain ecosystem, addressing several of the inherent challenges that Layer 1 blockchains face:

- Scalability: L2 solutions significantly increase the throughput of blockchain networks by moving transaction execution off-chain. For example, Ethereum currently handles around 15 transactions per second (TPS) on its Layer 1, but with L2 rollups, that number can jump to thousands of TPS.

- Cost Reduction: Since transactions are aggregated off-chain and only periodically submitted to the Layer 1 network, the fees associated with each individual transaction are drastically reduced. This makes blockchain technology more accessible for micro-transactions and smaller users.

- Faster Transactions: L2 solutions process transactions faster, bypassing the often slow confirmation times that can occur on congested Layer 1 blockchains.

- Ecosystem Expansion: Layer 2 opens the door to a wider range of applications, from decentralized finance (DeFi) and non-fungible tokens (NFTs) to supply chain management and gaming. The improvements in speed and cost make these use cases more viable.

While these benefits are compelling, they often come with a hidden trade-off—centralization.

Also, read – Amazing Ways Layer 2 Protocols Are Paving The Way For Scalable Ethereum Applications

The Centralization Problem in Layer 2 Solutions

Layer 2 solutions are designed to be more efficient, but their structure often leads to centralization tendencies, which can have detrimental consequences for the broader blockchain ecosystem. Here are the key aspects of L2 centralization and why it poses a threat:

1. Custodial Risks

One of the most prominent concerns with L2 solutions is custodial control. In many Layer 2 systems, users are required to deposit funds into an off-chain solution (such as a payment channel or rollup) to participate. This creates a reliance on centralized or semi-centralized entities to manage those funds.

For instance, the Lightning Network, a Layer 2 solution for Bitcoin, requires users to open channels with a counterparty to transact. Although Lightning is technically a non-custodial solution, the concentration of large nodes and liquidity providers introduces centralization risks. If major nodes or liquidity hubs dominate the network, they can control significant amounts of funds, posing a potential threat to decentralization and user sovereignty.

2. Validator and Sequencer Centralization

Another concern in many Layer 2 systems is the role of centralized validators or sequencers. In rollups, for instance, sequencers play a critical role in ordering transactions before they are submitted to the Layer 1 blockchain. In some cases, the sequencer is controlled by a single entity or a small group of entities, introducing a significant centralization risk.

When a single entity has control over transaction ordering and validation, it opens the door to censorship, market manipulation, and even malicious attacks. If these centralized sequencers fail, go rogue, or are compromised, the entire Layer 2 system could be vulnerable.

3. Governance Centralization

Governance centralization is another significant issue in many Layer 2 solutions. Unlike Layer 1 blockchains, where governance is often decentralized across a broad set of nodes and stakeholders, Layer 2 governance tends to be more centralized, especially in early stages of development.

The centralization of governance often occurs because L2 solutions are built by private companies or small development teams. These teams may maintain control over key upgrades, decision-making processes, and parameters that define how the Layer 2 system operates. This concentration of power can lead to issues where the broader community has little say in the direction of the Layer 2 solution, undermining the ethos of decentralized governance that blockchain was founded upon.

4. Bridges and Interoperability Risks

Bridges between Layer 1 and Layer 2 solutions, as well as between different Layer 2 systems, can introduce another centralization point. These bridges are often controlled by a single entity or a consortium of entities, meaning that users must trust these intermediaries to process and secure their transactions properly.

If a bridge is compromised or the entities running it act maliciously, the funds and transactions passing through it could be at risk. This undermines the trustless nature of blockchain technology and creates an unnecessary dependency on centralized actors.

5. Concentration of Power Among Liquidity Providers

In many Layer 2 scaling solutions, liquidity providers play a crucial role in facilitating transactions and enabling users to move funds between L1 and L2. However, if the majority of liquidity is controlled by a few large providers, they can have disproportionate power over the system.

For example, if a few large liquidity providers control most of the channels in the Lightning Network or dominate rollup liquidity pools, they can exert control over transaction fees, access to liquidity, and even censor certain users or transactions. This concentration of power contradicts the ideals of decentralization and trustless participation that blockchain technology strives for.

The Dangers of L2 Centralization

Centralization at the Layer 2 level presents several dangers to the blockchain ecosystem. Here’s why these risks are a ticking time bomb for the future of blockchain:

1. Censorship

One of the most significant dangers of Layer 2 centralization is the potential for censorship. If centralized entities control transaction ordering, validation, or liquidity, they can selectively block or censor certain transactions. This could be done for various reasons, including regulatory pressure, profit motives, or even political influence.

Censorship undermines one of the fundamental promises of blockchain: permissionless access. A system that can censor transactions is no longer truly decentralized or trustless, and it can be exploited to suppress certain users or groups.

2. Security Risks

Centralization also introduces security risks. In a decentralized system, even if one node or validator is compromised, the network remains secure because no single entity has control. However, when a Layer 2 solution centralizes key functions, such as validation or liquidity provision, the security of the entire system becomes dependent on the integrity of a few actors.

If these centralized actors are hacked, coerced, or act maliciously, they can wreak havoc on the Layer 2 network, potentially causing users to lose funds or disrupting the entire system.

3. Regulatory Capture

As Layer 2 solutions centralize, they become more vulnerable to regulatory capture. Governments and regulators may find it easier to impose rules, restrictions, or taxes on a small group of centralized actors than on a decentralized network of nodes.

For instance, if a government wants to impose strict anti-money laundering (AML) regulations on a Layer 2 solution, it can target the centralized entities that control validation or liquidity. This could result in overreach, where certain transactions or users are blocked, and privacy is compromised.

4. Reduced Trust

Decentralization is at the heart of blockchain’s value proposition. It enables users to interact in a trustless manner, without relying on intermediaries or centralized authorities. If Layer 2 solutions centralize control, users may lose trust in the system, especially if they are subject to censorship, higher fees, or limited access.

Trust erosion can lead to lower adoption rates, a diminished user base, and ultimately a collapse of the blockchain’s value. Users may seek alternatives that remain true to the decentralized ethos, further fragmenting the ecosystem.

5. Erosion of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has been one of the most promising use cases for blockchain technology, offering permissionless, decentralized access to financial services. However, many DeFi applications rely on Layer 2 solutions to scale. If Layer 2 centralizes, the entire DeFi ecosystem could be at risk.

Centralized Layer 2 networks could introduce vulnerabilities that allow for market manipulation, censorship of certain transactions, or the monopolization of liquidity. This could destroy the trust and open nature of DeFi, which is one of its primary advantages over traditional finance.

Conclusion: The Need for Caution and Innovation

Layer 2 solutions are essential for the scalability of blockchain technology, but they come with significant centralization risks that could threaten the future of decentralization. While L2 technologies bring much-needed efficiency, their reliance on centralized actors introduces dangers such as censorship, security vulnerabilities, and regulatory capture.

To prevent Layer 2 centralization from becoming a ticking time bomb, the blockchain community must prioritize decentralization in the design and governance of L2 systems. This may involve creating more decentralized validation mechanisms, distributing control over liquidity, and ensuring that users retain sovereignty over their funds and transactions.

Innovation in the blockchain space should always be aligned with the core principles of decentralization, and any compromises made for scalability should be weighed carefully against the risks of centralization. By maintaining a commitment to decentralization, blockchain technology can continue to offer a trustless, open, and censorship-resistant alternative to traditional systems, fulfilling its original promise.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  XRP

XRP  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  Avalanche

Avalanche  TRON

TRON  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Polkadot

Polkadot  Chainlink

Chainlink  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Sui

Sui  Pepe

Pepe  NEAR Protocol

NEAR Protocol  LEO Token

LEO Token  Litecoin

Litecoin  Uniswap

Uniswap  Aptos

Aptos  Wrapped eETH

Wrapped eETH  Internet Computer

Internet Computer  USDS

USDS  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Ethena USDe

Ethena USDe  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Dai

Dai  WhiteBIT Coin

WhiteBIT Coin  Celestia

Celestia  Bonk

Bonk  Filecoin

Filecoin  Stacks

Stacks  dogwifhat

dogwifhat  OKB

OKB