IntelMarkets (INTL) and Solana (SOL) to Lead the Next Bull Run, Analysts Predict 50x Returns by 2025

Crypto pundits are optimistic that IntelMarkets (INTL) and Solana (SOL) will champion the next phase of the bull run, predicting a 50x gain for this duo by 2025. This prediction comes as INTL and SOL exhibit bullish behaviors, sparking optimism about their future, both in the near and long term.

IntelMarkets Prepared to Lead the Next Bull Run, Expert Says

Experts are optimistic about the prospect of IntelMarkets ushering in the next crypto market bull run based on its price outlook. While in its presale stage, INTL has achieved significant growth, delivering notable gains to investors.

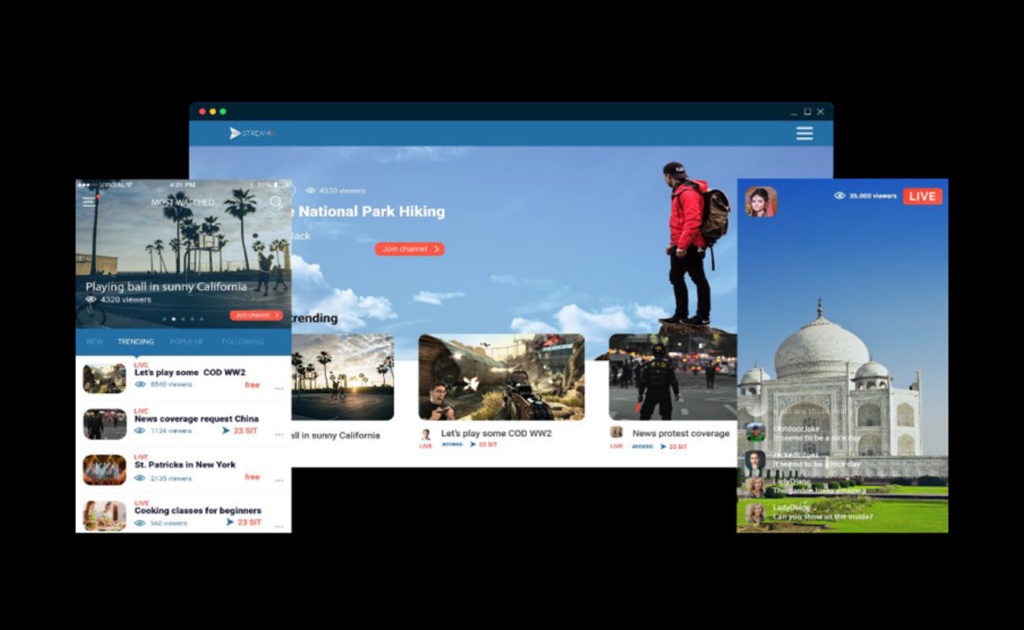

However, the success of INTL can be traced back to its native platform, IntelMarkets. As a marketplace built on two blockchains, IntelMarkets is an innovative platform designed for futures traders to speculate on the potential price behaviors of different asset pairs.

The platform supports Ethereum and Solana, using their powers to improve users’ trading experiences. Given its dual-chain structure, IntelMarkets processes transactions faster and cost-effectively, and it is flexible in that users can access decentralized protocols, smart contracts, and numerous asset pairs.

Moreover, IntelMarkets offers cutting-edge tools to position users ahead of the competition. One of the most noteworthy of them is a self-learning robot that can automate the usual activities investors do.

Traders will also be able to copy the trades of expert traders, use AI tools, and access up to 1,000 technical analyses. Furthermore, IntelMarkets will grant users access to numerous asset pairs and advanced trading leverages reaching 1,000x to increase their potential gains as they trade.

INTL is in Stage 3 of its public presale, trading at $0.027 per token. As the presale inches towards the end, investors in INTL are well-positioned for up to a 300% profit on their investment when the price cracks $0.11 at the end of the final stage.

Analyst Calls $160 a Breaking Point For Solana: Path to New Height?

Over the past few weeks, Solana has demonstrated significant ups and downs, resulting in uncertainty amongst investors. Market players are now treading carefully around SOL as they look to technical indicators for insight into its potential price action.

In the same vein, Daan Crypto, a well-known analyst, has shared his perspective on Solana in an October 5, 2024, post on X. According to Daan, SOL has established almost three equal highs around the $160 region.

Right now, he added, Solana is forming higher lows, signaling a build-up of bullish momentum. Daan believes this could trigger SOL to surpass the $160 price level, fueling a turnaround for the asset.

The analyst noted that the $160 is a critical price point for SOL as its action at this level will determine its future behavior. In particular, if SOL crushes this level, the asset could push to new highs, flipping the overall sentiment for Solana into a positive.

At present, SOL is testing the 200-day EMA, a key resistance level, on the 4-hour chart. If the asset can conquer this resistance level, its next stop will likely be $160.

SOL is currently trading at $145, up 2.93% in the last 24 hours. When the bull run finally sets in, experts believe SOL could reach unprecedented heights.

INTL And SOL Target a 50x Price Rally During the Bull Run

As the bull run approaches, experts note that INTL and SOL might experience a 50x surge. This projection suggests that buying these coins at their current prices could be a steal. Hence, smart investors are swooping in, and so should you.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions. The featured image used is just a creative depiction of the title and it does not intend to hurt sentiments of any person or institution. If it hurts anyone sentiments, please do not hesitate to reach out to Blockchain Magazine.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Official Trump

Official Trump  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Ethereum Classic

Ethereum Classic  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Render

Render  Dai

Dai  Bittensor

Bittensor  Algorand

Algorand