How A Cryptocurrency Dip Is An Opportunity?

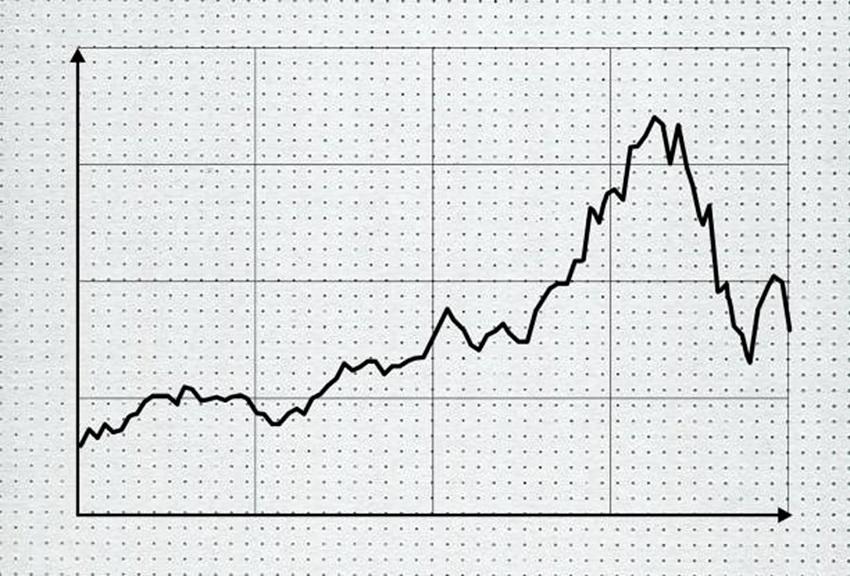

The volatile nature of digital assets is an inevitable part of their ever-changing landscape. Many cryptocurrencies like Bitcoin and Ethereum fluctuate at a dramatic speed. For investors, these swings, known as a “cryptocurrency dip,” may be unsettling.

But there are also special chances that arise because of them. With bitcoin market statistics and expert opinions as support, this article will explain why a price drop presents an opportunity for investors.

While dips may seem like bad news to some investors, individuals with market knowledge and a long-term outlook might see them as excellent buying opportunities. We’re going to look at the reasons why a price drop in cryptocurrencies might be a good buying opportunity.

Buying assets at a discount is one of the most obvious benefits of a crypto price drop. During market downturns, cryptocurrency values often fall dramatically, giving buyers a chance to stock up at a discount from recent highs. Investors wishing to either get their feet wet in the market or add to their current holdings may find this to be an enticing opportunity.

What Does The Term “Buy The Dip” Mean?

“Buy the dip” is a term used in the cryptocurrency market to describe the chance to purchase a coin or token after its value has dropped. It is expected that the asset’s value would recover from this temporary drop (or “dip”), making the current price a steal. The goal of the “buy the dip” approach is to capitalize on a stock’s decline in the short term, whether by day trading or swing trading (holding a position for weeks or months). Traders in either situation are often trying to make money off of a stock that has been “oversold,” or has fallen too much in too short a time before it is expected to rise again.

Rather than buying fantastic firms on the cheap and letting their business success determine your returns, you will be actively trying to time the market. Instead, success depends on anticipating market moves and trading ahead of other investors and dealers. An investor is averaging down if they are already long and purchase on price drops. The term “averaging down” refers to a technique used by investors in which they buy more shares of a stock after its price has fallen even more. However, it is claimed that purchasing a drop is adding to a loss if it does not lead to a later upturn.

Should You Buy Cryptocurrency on the Dip?

The theory behind the “buy the dip strategy” is that price declines are short-lived and that, in the long term, prices will rise back to their starting points. For investors, this means keeping an eye out for opportunities to buy high-quality assets at a bargain. The bitcoin market is more volatile than traditional financial markets. As a result, buying cryptocurrencies during a slump that might continue for a long period is very risky, regardless of the price. Cryptocurrency prices may bounce back, but it’s also possible that they’ll keep falling, putting you and your assets in jeopardy. There’s a chance that the current cryptocurrency price dip may lead to a recovery similar to 2021’s, but there’s also a chance that it won’t.

Determine how much of your monthly budget you can allocate to Bitcoin purchases if you’re intent on buying the dip. Also, try not to stress too much about potential price changes over the next few years. It’s important to safeguard the value of your digital currency holdings.

Diversifying your cryptocurrency assets by acquiring many alternative currencies (altcoins) may help mitigate the risk of loss.

How to Buy a Cryptocurrency Dip and Make Money?

There are a few ways to make substantial profits by purchasing the dip in the long run. Three of the most well-known are as follows:

1. Buy The Best Assets In A Declining Market

Buying the top one or two cryptocurrencies in a sector that has crashed because investors have turned against it might be a good investment opportunity. If you look forward to a few years, you may find the companies with the greatest competitive advantages and acquire them before the market flips around.

2. Invest In The Most Popular Digital Currencies

Bitcoin is one of the most well-known cryptocurrencies today. It is one of the most unstable assets ever, having weathered some of the worst disasters ever recorded. In 2011, the price of bitcoin dropped to its all-time low, falling by more than 99%. It’s a marvel that the market gave back even a fraction to investors after that.

Bitcoin, however, has been able to ride out the storm of volatility and continue its steady rise ever since it was first introduced. Performance histories are often decisive. Bitcoin and other cryptocurrencies will likely rebound from a downturn if they too can weather a series of high-profile crises. However, you can check out the price volatility of your digital assets with auto trading bots like Ethereum Code and stay up-to-date about the latest crypto market trends.

3. Use An Index Fund To Invest In The Market

Investing in the market using an index fund is a viable option if you don’t want to research individual companies or industries. You may buy low and sell high by investing in a fund tracking the S&P 500 Index, which gives you exposure to hundreds of the best firms in the United States. It’s Warren Buffett’s advice for most investors and a great option for those who don’t have the time or energy to dedicate to more rigorous investing.

4. When Prices Climb, You May Buy Some Dips

An uptrend occurs when there is a consistent rise in the value of a certain asset. Its highs and lows are, on average, greater than those of the previous period. This demonstrates that it is beneficial to increase prices after they have dropped.

Many traders and investors believe that the price of a coin or stock will eventually recover from a dip and rise again. Unfortunately, this approach is still a viable idea even if it has failed in the past. In truth, there is no way to predict the future of a certain item.

Using the signal line is one way to lessen potential complications. For instance, this threshold shouldn’t be tested if the price of a certain cryptocurrency is widely believed to be rising. As soon as this happens, the currency in question may have already begun to decline, purchasing dips a losing proposition for everyone.

Last Words

After figuring out your risk tolerance and prioritising other elements of your money, the greatest time to invest in cryptocurrencies is when prices are low, according to experts. Your whole plan should only include what you can afford to lose. Most financial advisors advise against allocating more than 5% of your portfolio to cryptocurrencies. Carefully weigh the benefits against the costs before deciding to purchase the dips. One alternative is to invest your whole portfolio under a risk-adjusted asset allocation that takes into account both your short-term and long-term objectives.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Sui

Sui  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Chainlink

Chainlink  Shiba Inu

Shiba Inu  Stellar

Stellar  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  USDS

USDS  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Mantle

Mantle  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  MANTRA

MANTRA  Render

Render  Monero

Monero  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Tokenize Xchange

Tokenize Xchange  Filecoin

Filecoin  Virtuals Protocol

Virtuals Protocol