Donald Trump’s Crypto Wallet Portfolio Is $15M Strong In Jan 2025, but What Can Happen Next?

So, Donald Trump is making waves in the crypto world with a portfolio worth $15 million as of January 2025. It’s got everyone talking, and for good reason. With the crypto market being as unpredictable as it is, people are curious about what this means for the future. Will Trump’s investments shake things up, or is it just another headline? Let’s break it down and see what might be around the corner.

Key Takeaways

- Donald Trump has invested $15 million in various cryptocurrencies as of January 2025.

- His investment choices could influence market trends and investor behavior.

- There are potential legal and regulatory challenges that could impact his holdings.

- Technological advancements in crypto could change the value of his investments.

- Comparing Trump’s strategy with other billionaires offers insights into different investment approaches.

Donald Trump’s Crypto Wallet: A Deep Dive

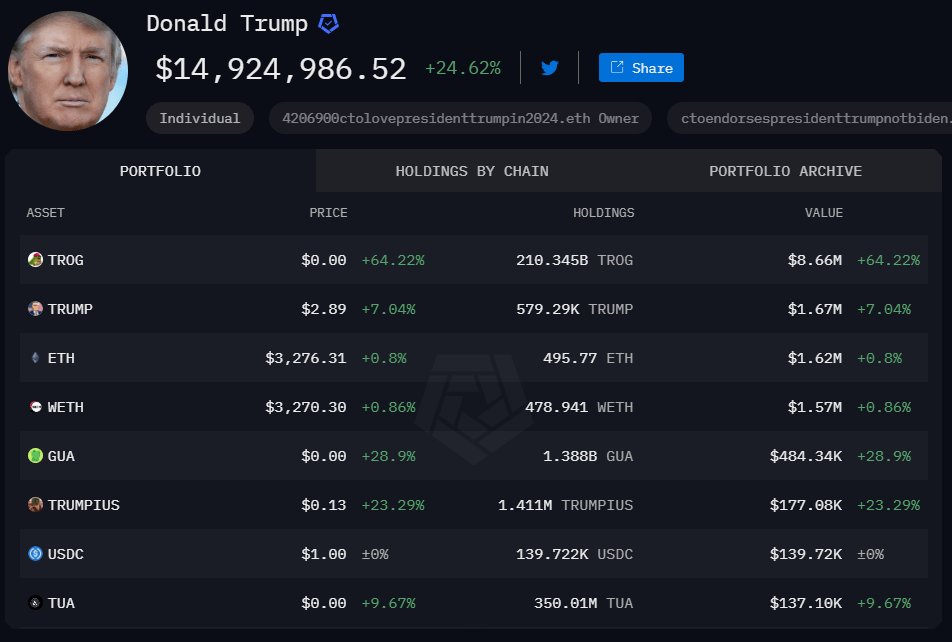

Overview of Trump’s Cryptocurrency Holdings

Donald Trump, known for his diverse investment portfolio, has made significant strides in the world of cryptocurrency. As of January 2025, his crypto holdings are valued at an impressive $15 million. His portfolio is a mix of both well-established coins and emerging digital currencies. It’s fascinating to see how someone traditionally associated with real estate has ventured into the digital currency space. This move reflects a broader trend among wealthy individuals diversifying their investments in response to the evolving financial landscape.

Key Cryptocurrencies in Trump’s Portfolio

Trump’s crypto portfolio isn’t just about holding Bitcoin and Ethereum, although they do make up a substantial portion. He has also invested in a variety of altcoins, including some lesser-known but promising options. Here’s a snapshot of his key holdings:

- Bitcoin (BTC): The cornerstone of his portfolio, reflecting the general confidence in its stability and growth potential.

- Ethereum (ETH): Valued for its smart contract capabilities, making it a staple in his collection.

- Ripple (XRP): Chosen for its potential in revolutionizing international payments.

In addition to these, Trump’s portfolio includes several emerging cryptocurrencies that hint at his willingness to take calculated risks.

How Trump’s Crypto Strategy Has Evolved

Initially, Trump’s approach to cryptocurrency was cautious, mirroring his traditional investment style. However, over time, he has embraced a more aggressive strategy, seizing opportunities in the volatile crypto market. This shift is evident in his adoption of newer technologies and platforms that promise high returns.

Trump’s evolving strategy highlights a broader acceptance of digital currencies among traditional investors. His willingness to adapt and explore new avenues in the crypto world is a testament to the growing influence of digital assets in today’s economy.

His journey from skepticism to active participation in the crypto space is not just about potential profits but also about staying relevant in a rapidly changing market. As the cryptocurrency market continues to expand, Trump’s moves will undoubtedly be watched closely by both supporters and critics alike.

The Impact of Trump’s Crypto Investments on the Market

Market Reactions to Trump’s Crypto Moves

Donald Trump’s foray into the crypto world has been nothing short of a spectacle. His investments have stirred waves in the market, with traders and investors keeping a close eye on his portfolio’s every move. Market analysts note that Trump’s crypto decisions often lead to volatile swings, as his influence can sway investor sentiment significantly.

- Traders often anticipate Trump’s next move, leading to speculative buying or selling.

- His public statements about cryptocurrency can cause immediate price fluctuations.

- Trump’s holdings in major cryptocurrencies often set trends that others follow.

Influence on Cryptocurrency Trends

Trump’s involvement has undeniably shaped certain trends within the crypto sphere. His preference for certain coins over others can steer market interest and even alter the perceived value of specific cryptocurrencies.

- Bitcoin remains a staple in his portfolio, reinforcing its status as a leading digital asset.

- Emerging altcoins have gained attention due to strategic endorsements or investments by Trump.

- His moves have sparked debates on the future of traditional and digital finance integration.

Potential Ripple Effects on Global Markets

The global markets aren’t immune to the ripple effects caused by Trump’s crypto investments. As a key figure, his actions can lead to broader economic impacts, influencing not just crypto markets but traditional ones too.

- International markets may react to Trump’s crypto activities, affecting currency exchange rates.

- His investments could prompt regulatory bodies worldwide to reconsider their stance on digital currencies.

- There’s potential for increased cross-border crypto transactions as a result of Trump’s global influence.

Trump’s crypto portfolio isn’t just about numbers—it’s a reflection of how one individual’s financial moves can have far-reaching consequences. As we watch his investments unfold, the world waits to see what ripple effects will emerge.

Legal and Regulatory Challenges Facing Trump’s Crypto Portfolio

Regulatory Scrutiny and Compliance Issues

Navigating the regulatory landscape for cryptocurrencies is no small feat, and Trump’s crypto portfolio is under the microscope. With the appointment of David O. Sacks as the “Crypto Czar”, the U.S. is moving towards a more supportive environment for digital assets. However, compliance remains a challenge, with numerous regulations that can impact how Trump manages his holdings. Staying compliant while maximizing returns is a balancing act that requires constant vigilance.

Legal Implications of Crypto Investments

Crypto investments come with their own set of legal hurdles. Trump’s involvement in the crypto market could potentially expose him to legal risks due to the volatile nature of digital assets and the evolving legal frameworks governing them. Issues like tax implications, security classifications, and anti-money laundering laws are just a few areas where legal complications might arise. Being proactive in understanding these legalities is crucial to avoid potential pitfalls.

How Regulations Could Affect Trump’s Holdings

The regulatory environment can greatly influence Trump’s crypto portfolio. If stricter regulations are enacted, they could limit the growth potential of his investments. Conversely, favorable regulations might pave the way for expansion and increased profitability. It’s a game of wait and see, as the regulatory climate is ever-changing. Keeping an eye on policy changes and adapting quickly will be key to maintaining a robust portfolio.

As the crypto world continues to evolve, the intersection of legality and investment strategy becomes increasingly important. Trump’s ability to navigate these challenges will likely set the tone for other investors in the space.

Future Prospects for Trump’s Crypto Portfolio

Predictions for Trump’s Crypto Investments

Looking ahead, Trump’s crypto portfolio could see a variety of outcomes. Some experts believe that if he continues with his current strategy, his holdings might grow significantly in value. However, the ever-changing crypto market could bring unexpected turns.

Potential Growth Areas in Cryptocurrency

Trump’s portfolio might benefit from emerging sectors within the crypto space. Areas like decentralized finance (DeFi) and non-fungible tokens (NFTs) are gaining traction. Investors are keeping an eye on these as they could offer substantial returns.

- DeFi platforms providing decentralized banking services

- NFTs offering unique digital ownership

- Blockchain innovations improving transaction efficiency

Challenges and Risks Ahead for Trump’s Portfolio

While the future looks promising, there are hurdles. The crypto market is volatile, and sudden shifts can impact values dramatically.

Navigating these challenges requires a keen understanding of market trends and a willingness to adapt quickly.

Additionally, regulatory changes could pose risks. It’s crucial for investors to stay informed and prepared to adjust their strategies accordingly.

For those investing in cryptocurrencies, understanding the basics and implementing effective risk management techniques is essential to safeguard investments in this volatile market.

Comparing Trump’s Crypto Strategy to Other Billionaires

How Trump’s Approach Differs from Other Investors

Donald Trump’s approach to cryptocurrency is as bold as his personality. Unlike some investors who play it safe, Trump dives headfirst into the crypto market. He’s not afraid to make big moves that catch attention. While others might stick to well-known coins like Bitcoin and Ethereum, Trump explores a wider range of digital currencies, showing a willingness to take risks that many would shy away from.

Lessons from Other Billionaire Crypto Portfolios

Looking at other billionaires, we can see different strategies at play. For instance, Elon Musk famously influenced Dogecoin’s value through tweets, while Warren Buffett has stayed away from crypto altogether. Here are a few takeaways:

- Diversity: Many billionaires diversify their portfolios to spread risk.

- Long-term Vision: Some focus on long-term gains rather than quick profits.

- Influence: Public figures can sway market trends, intentionally or not.

What Sets Trump’s Strategy Apart

Trump’s strategy is unique because of his public persona and media presence. He’s not just investing; he’s making statements. This approach can lead to volatility in his portfolio’s value but also keeps him in the public eye.

Trump’s crypto strategy is more than just about making money. It’s about maintaining influence and staying relevant in a rapidly changing financial landscape.

Public Perception and Media Coverage of Trump’s Crypto Wallet

Media Reactions to Trump’s Crypto Investments

Media outlets have been buzzing about Trump’s $15 million crypto portfolio. Some see it as a bold move, while others are skeptical. Critics argue that Trump’s investments could be risky, given the volatile nature of the crypto market. On the flip side, supporters claim that his involvement might bring more attention and credibility to digital currencies. It’s a mixed bag, really.

Public Opinion on Trump’s Cryptocurrency Strategy

When it comes to public opinion, it’s all over the place. Some folks think Trump’s jumping on the crypto bandwagon is a smart financial move. Others, however, are worried about the potential for financial loss. Here’s what people are saying:

- “Trump’s always been a risk-taker. This is just another example.”

- “I wouldn’t trust my money in crypto, but hey, if he wants to, go for it.”

- “Is this really the best move for a former president?”

Impact of Media Coverage on Trump’s Portfolio

Media coverage can really sway public perception, and Trump’s crypto holdings are no exception. If the media paints his investments in a positive light, it could boost confidence and even attract more investors to the crypto market. On the other hand, negative coverage might lead to skepticism and caution among potential investors.

The media’s portrayal of Trump’s crypto ventures could either bolster the market or cast a shadow of doubt, influencing not just his portfolio but the broader crypto landscape.

In the end, how the media and public view Trump’s crypto dealings could have a ripple effect on the market itself. As regulatory clarity improves, as noted in the US’s influence on crypto innovation, the dynamics of such investments might shift, potentially impacting both Trump’s portfolio and the wider crypto community.

Technological Innovations and Their Impact on Trump’s Crypto Holdings

Emerging Technologies in Cryptocurrency

The crypto world is buzzing with new tech every day. From decentralized finance (DeFi) to non-fungible tokens (NFTs), the landscape is always shifting. Blockchain technology is at the heart of these innovations, providing a secure and transparent way to handle transactions. Trump’s portfolio might be influenced by these trends as they reshape the market.

- DeFi: Offering financial services without traditional banks.

- NFTs: Unique digital assets that are gaining popularity.

- Smart Contracts: Automated agreements that execute when conditions are met.

How Innovations Could Affect Trump’s Portfolio

Technological shifts can create new opportunities and risks. For instance, if Trump’s holdings include Ethereum, any upgrades or changes to its network could impact his investments.

As technology evolves, it can either bolster Trump’s portfolio or expose it to new vulnerabilities.

The Role of Blockchain in Trump’s Investments

Blockchain is the backbone of all cryptocurrencies. It ensures security and transparency. For Trump, this means his investments are shielded from fraud and manipulation. The ongoing development in blockchain tech might also open doors to new investment avenues.

- Security: Protects against fraud.

- Transparency: Ensures all transactions are visible.

- Innovation: Continually evolving to offer new possibilities.

In the end, staying updated with these technological trends is crucial for anyone in the crypto game, including Trump. As Donald Trump positioned himself as a pro-cryptocurrency candidate before the last presidential elections, these innovations might play a key role in shaping his strategies moving forward.

Wrapping It Up

So, there you have it. Donald Trump’s crypto stash is sitting at a cool $15 million as of January 2025. But what does that mean for the future? Well, the crypto world is as unpredictable as ever. Prices could skyrocket or take a nosedive, and Trump’s portfolio might follow suit. He’s known for making bold moves, so who knows what his next step will be. Maybe he’ll double down, or perhaps he’ll cash out and invest elsewhere. Whatever happens, it’s bound to keep everyone guessing. One thing’s for sure, though—crypto isn’t going anywhere, and neither is the buzz around Trump’s investments.

Frequently Asked Questions

What is Donald Trump’s cryptocurrency portfolio worth in January 2025?

In January 2025, Donald Trump’s cryptocurrency portfolio is valued at $15 million.

Which cryptocurrencies does Donald Trump own?

Donald Trump owns a variety of cryptocurrencies, but the specific ones are not publicly disclosed.

How has Donald Trump’s approach to cryptocurrency changed over time?

Trump’s approach to cryptocurrency has evolved, adapting to market trends and regulatory changes.

What impact does Trump’s investment in crypto have on the market?

Trump’s investments can influence market trends and investor behavior, causing shifts in cryptocurrency values.

Are there any legal issues with Trump’s crypto investments?

Trump’s crypto investments face legal and regulatory scrutiny, which could affect his holdings.

How does Trump’s crypto strategy compare to other billionaires?

Trump’s strategy is unique and differs from other billionaires, focusing on different aspects of the crypto market.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Stellar

Stellar  Shiba Inu

Shiba Inu  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Hedera

Hedera  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Hyperliquid

Hyperliquid  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  USDS

USDS  Ethena USDe

Ethena USDe  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Mantle

Mantle  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Render

Render  MANTRA

MANTRA  Monero

Monero  Bittensor

Bittensor  Tokenize Xchange

Tokenize Xchange  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Dai

Dai  Filecoin

Filecoin  Algorand

Algorand