Cardano Loses Steam to Newcomers Avalanche and DTX Exchange, Why are Holders Ditching ADA?

As June concludes, Cardano (ADA) and Avalanche (AVAX) have become popular among investors, yet recent trends suggest a huge shift. With Avalanche showing impressive resistance and DTX gaining traction, many holders are reevaluating their positions in Cardano (ADA)

New Blockchain Integration Might Pump AVAX Price To $30

Avalanche (AVAX) has quickly established itself as a leading altcoin since its launch in 2020 by Ava Labs. In a recent development, Ava Labs revealed its plan to offer intellectual property management solutions to South Korean K-pop artists using Avalanche.

According to a recent Allied Research report, the K-pop industry, including sponsorship deals, ticket sales, and merchandising, is projected to reach a valuation of $20 billion by 2031. Currently trading at $26.00, AVAX’s price has dropped by 4.98% over the past week. Its market cap is at $10.24B, with trading volume at $296.39M, while the 33.02 RSI indicates it is nearing oversold territory.

Cardano (ADA) Loses The Spotlight Amid SEC Conflicts

Despite being regarded as the next-generation blockchain platform, Cardano (ADA) is facing major regulatory and technical challenges. The SEC’s classification of ADA as a security has resulted in its delisting from several U.S. trading platforms, leading to a 26% market value decline since January. This regulatory pressure has significantly affected investor confidence.

Recent performance metrics for Cardano (ADA) raise concerns among investors. Cardano (ADA) is trading at $0.39, reflecting a 14.93% decline over the past month. Its market cap is $13.97 billion, with a 24-hour trading volume of $238 million, which has plummeted by 31.00%. The RSI for ADA is 38.82, suggesting it is approaching oversold conditions.

DTX Exchange Outshines Cardano (ADA) & Avalanche (AVAX)

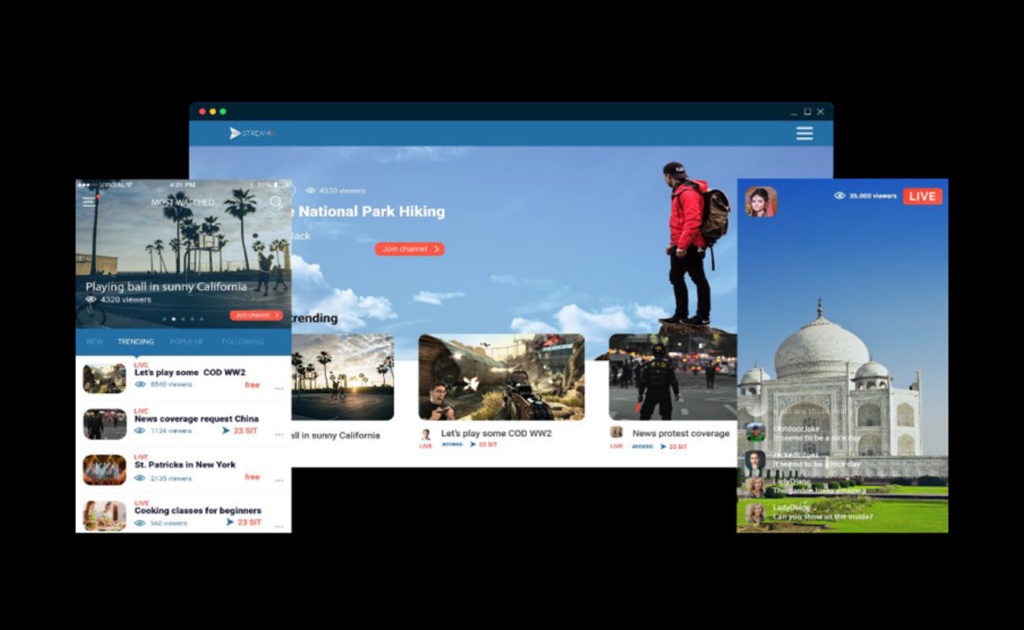

As Cardano (ADA) and Avalanche (AVAX) investors look for alternatives to diversify their portfolios, DTX Exchange has entered the market with a bang. The network captures the crypto community’s attention with a comprehensive set of rules and guidelines that ensure transparency, security, and efficiency for all participants.

DTX Exchange leverages distributed liquidity pools to enhance liquidity and reduce slippage. It aggregates liquidity from multiple sources to create a more efficient trading environment. This hybrid model combines elements of centralized and decentralized exchanges, maintaining decentralization’s security and privacy benefits.

Smart contracts, powered by blockchain technology, play a vital role in executing and enforcing the rules of the DTX protocol. They facilitate secure and automated transactions, ensuring users execute trades as intended.

DTX Exchange (DTX) Premium Trading Options Attract Investors

The DTX protocol employs an on-chain order book that transparently records all buy and sell orders. This transparency ensures that the trading process is verifiable by all participants, enhancing trust and reliability.

As the DTX Exchange gains traction, it is poised to attract traders who value security and efficiency, potentially making investors ditch established altcoins like Cardano (ADA) and Avalanche (AVAX) in the long run.

While Cardano (ADA) and Avalanche continue to hold major positions in the crypto market, their recent struggles highlight the importance of adaptability. DTX Exchange, with its unique approach and promising features, represents the next-gen future of cryptocurrency trading.

Learn more:

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena