Bitcoin Fails to Find Momentum as Governments Selling Over $5 Billion in BTC, Why is DTX Exchange Surging?

The U.S. Government is the biggest holder of Bitcoin, worth $5 billion, which is around 200,000 Bitcoin. Despite the intensifying federal crackdown on the crypto industry, the treasury holds a whopping 207,189 Bitcoins, valued at $5 billion, making it the largest state-owned stash of its kind.

They have already sold Bitcoin worth millions and maybe want to get rid of the remaining in their possession. BTC price has already lost its momentum, a few days ago, it was trading near its all-time high, and now it is trading more than 15% below.

On June 25, the German government also sold millions worth of Bitcoin. We will discuss, what will be the impact of these huge sellings on BTC price and why BTC investors are betting on the new trading platform DTX Exchange.

German Government Sold $54 Million Worth of Bitcoin

The German government is selling off its seized Bitcoin assets amid a recent dip in cryptocurrency prices. They have started liquidating parts of their substantial Bitcoin holdings worth about $3 billion.

Recently, a crypto wallet labeled “German Government (BKA)” sold over $54 million of Bitcoin. This wallet sold 900 Bitcoin in three separate transactions on June 25.

Despite these significant transactions, the German government-linked Bitcoin wallet still holds a total of 46,359 BTC, valued at around $2.8 billion at current prices.

BTC Price Struggles to Hold $60,000

All these updates on selling have put tremendous pressure on the BTC price. It is currently trading above the $60,000 mark but has already made an undercut on it. The Current BTC Price is crucial because the $60,000 level is an important support zone and a sentimental level.

The BTC price has been steadily falling since the start of this month and has decreased over 9% this month. Although it reached an ATH of $73,794 in March, it hasn’t managed to keep its upward momentum. If Bitcoin doesn’t bounce back soon, we might see the beginning of a new downtrend.

DTX Exchange Already Doubled in a Month

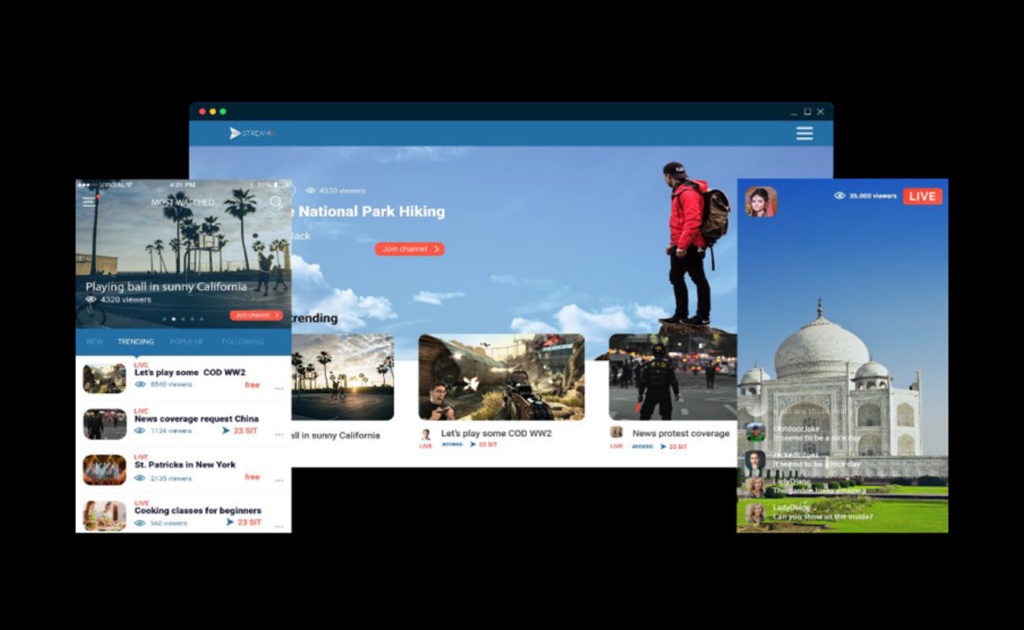

Despite the strong bearish momentum in the BTC price and overall crypto market, the new trading platform DTX Exchange has already doubled in a month from the launch price of $0.02 to currently trading at $0.04.

DTX Exchange is the first major exchange to provide 1000X leverage to users without KYC requirements. The platform has a state-of-the-art infrastructure and unique trading features, offering solid opportunities.

With a community-focused approach, the platform allows traders to optimize their investments with low trading fees. Community members enjoy governance and voting rights and will soon access potential airdrops. Considering the project’s promising outlook, the current price of $0.04 makes it highly undervalued.

DTX Exchange (DTX) has attracted significant investor interest, securing over $2 million in private seed rounds and raising over $750K in a public presale, which is expected to hit $2 million by the end of July.

Click here to visit the presale.

Stay informed with daily updates from Blockchain Magazine on Google News. Click here to follow us and mark as favorite: [Blockchain Magazine on Google News].

Get Blockchain Insights In Inbox

Stay ahead of the curve with expert analysis and market updates.

latest from tech

Disclaimer: Any post shared by a third-party agency are sponsored and Blockchain Magazine has no views on any such posts. The views and opinions expressed in this post are those of the clients and do not necessarily reflect the official policy or position of Blockchain Magazine. The information provided in this post is for informational purposes only and should not be considered as financial, investment, or professional advice. Blockchain Magazine does not endorse or promote any specific products, services, or companies mentioned in this posts. Readers are encouraged to conduct their own research and consult with a qualified professional before making any financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena